Time Warner Cable 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

obligation at fair value in other current liabilities in the consolidated balance sheet. The fair value of the equity award

reimbursement obligation to Time Warner was estimated using the Black-Scholes model. The change in the equity award

reimbursement obligation fluctuated primarily with the fair value and expected volatility of Time Warner common stock

and changes in fair value were recorded in other income, net, in the period of change. On March 12, 2014, all remaining

outstanding Time Warner stock options held by TWC employees expired and the Company was obligated to reimburse

Time Warner $6 million, which consisted of the intrinsic value of awards exercised through March 12, 2014 for which

payment had not yet been made. As of March 12, 2014, the Company no longer viewed this obligation as a derivative

financial instrument valued using Level 3 fair value measurements as the $6 million remaining liability was fixed.

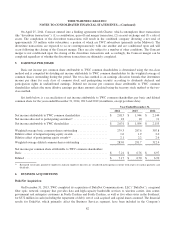

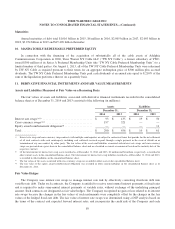

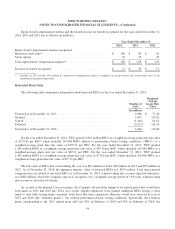

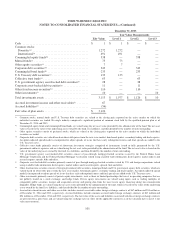

Changes in the fair value of the equity award reimbursement obligation, valued using significant unobservable inputs

(Level 3), from January 1 through December 31 are presented below (in millions):

2014 2013 2012

Balance at beginning of year .............................................. $ 11 $ 19 $ 22

(Gains) losses recognized in other income, net ................................ (1) 10 9

Payments to Time Warner for awards exercised ............................... (4) (18) (12)

Transfer out of Level 3 (and subsequently paid) ............................... (6) — —

Balance at end of year ................................................... $ — $ 11 $ 19

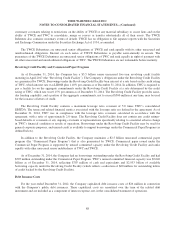

Assets Measured at Fair Value on a Nonrecurring Basis

The Company’s assets measured at fair value on a nonrecurring basis include equity-method investments, long-lived

assets, indefinite-lived intangible assets and goodwill. The Company reviews the carrying amounts of such assets

whenever events or changes in circumstances indicate that the carrying amounts may not be recoverable or at least

annually as of July 1 for indefinite-lived intangible assets and goodwill. Any resulting asset impairment would require that

the asset be reduced to its fair value. Refer to Note 8 for further details regarding the results of the Company’s fair value

analysis of cable franchise rights and goodwill.

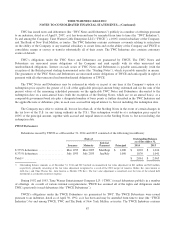

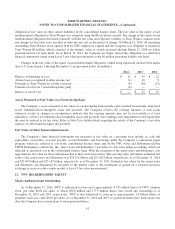

Fair Value of Other Financial Instruments

The Company’s other financial instruments not measured at fair value on a recurring basis include (a) cash and

equivalents, receivables, accounts payable, accrued liabilities and borrowings under the Company’s commercial paper

program, which are reflected at cost in the consolidated balance sheet, and (b) the TWC Notes and Debentures and the

TWCE Debentures (collectively, the “senior notes and debentures”) not subject to fair value hedge accounting, which are

reflected at amortized cost in the consolidated balance sheet. With the exception of the senior notes and debentures, cost

approximates fair value for these instruments due to their short-term nature. The carrying value and related estimated fair

value of the senior notes and debentures was $23.126 billion and $27.842 billion, respectively, as of December 31, 2014

and $25.003 billion and $25.187 billion, respectively, as of December 31, 2013. Estimated fair values for the senior notes

and debentures are determined by reference to the market value of the instrument as quoted on a national securities

exchange or in an over-the-counter market (a Level 1 fair value measurement).

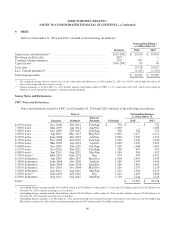

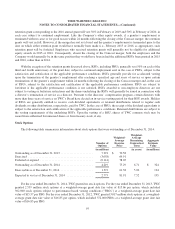

12. TWC SHAREHOLDERS’ EQUITY

Shares Authorized and Outstanding

As of December 31, 2014, TWC is authorized to issue up to approximately 8.333 billion shares of TWC common

stock, par value $0.01 per share, of which 280.8 million and 277.9 million shares were issued and outstanding as of

December 31, 2014 and 2013, respectively. TWC is also authorized to issue up to approximately 1.0 billion shares of

preferred stock, par value $0.01 per share. As of December 31, 2014 and 2013, no preferred shares have been issued, nor

does the Company have current plans to issue preferred shares.

91