Time Warner Cable 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

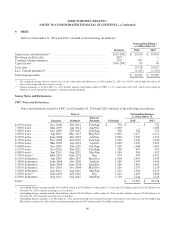

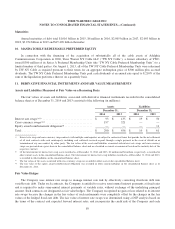

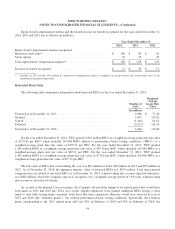

counterparty (a Level 2 fair value measurement). The following table summarizes the terms of existing fixed to variable

interest rate swaps as of December 31, 2014 and 2013:

December 31,

2014 2013

Maturities .................................................................. 2015-2019 2014-2019

Notional amount (in millions) ................................................... $ 6,100 $ 7,850

Weighted-average pay rate (variable based on LIBOR plus variable margins) ............. 4.78% 4.89%

Weighted-average receive rate (fixed) ............................................ 6.58% 6.86%

The notional amounts of interest rate instruments, as presented in the above table, are used to measure interest to be

paid or received and do not represent the amount of exposure to credit loss.

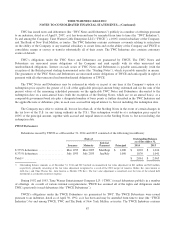

Cash Flow Hedges

The Company uses cross-currency swaps to manage foreign exchange risk related to foreign currency denominated

debt by effectively converting foreign currency denominated debt, including annual interest payments and the payment of

principal at maturity, to U.S. dollar denominated debt. Such contracts are designated as cash flow hedges. The Company

has entered into cross-currency swaps to effectively convert its £1.275 billion aggregate principal amount of fixed-rate

British pound sterling denominated debt, including annual interest payments and the payment of principal at maturity, to

fixed-rate U.S. dollar denominated debt. The cross-currency swaps have maturities of June 2031 and July 2042. The fair

value of cross-currency swaps was determined using a DCF analysis based on expected forward interest and exchange

rates, and incorporates the credit risk of the Company and each counterparty (a Level 2 fair value measurement). The

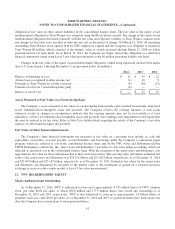

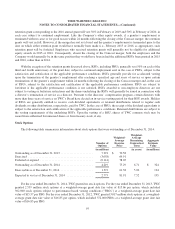

following table summarizes the deferred gain (loss) activity related to cash flow hedges recognized in accumulated other

comprehensive income (loss), net, and reclassified into other income, net, for the years ended December 31, 2014, 2013

and 2012 (in millions):

Year Ended December 31,

2014 2013 2012

Deferred gains (losses) recognized:

Cross-currency swaps ........................................... $ (124) $ 209 $ 179

Deferred (gains) losses reclassified into earnings:

Cross-currency swaps(a) .......................................... 126 (39) (76)

Total net deferred gains recognized ................................... 2 170 103

Income tax provision .............................................. (1) (66) (40)

Total net deferred gains recognized, net of tax .......................... $ 1 $ 104 $ 63

(a) Deferred gains (losses) on cross-currency swaps were reclassified from accumulated other comprehensive income (loss), net, to other income, net,

which offsets the re-measurement gains (losses) recognized in other income, net, on the British pound sterling denominated debt.

Any ineffectiveness related to the Company’s cash flow hedges has been and is expected to be immaterial.

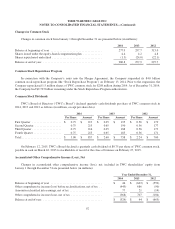

Equity Award Reimbursement Obligation

Prior to 2007, some of TWC’s employees were granted options to purchase shares of Time Warner Inc. (“Time

Warner”) common stock in connection with their past employment with subsidiaries and affiliates of Time Warner,

including TWC. Upon the exercise of Time Warner stock options held by TWC employees, TWC was obligated to

reimburse Time Warner for the excess of the market price of Time Warner common stock on the day of exercise over the

option exercise price (the “intrinsic” value of the award). The Company recorded the equity award reimbursement

90