Time Warner Cable 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

The income tax provision and effective tax rate for 2012 include (i) a benefit of $63 million related to a change in the

tax rate applied to calculate the Company’s net deferred income tax liability as a result of an internal reorganization

effective on September 30, 2012, (ii) a fourth-quarter benefit of $47 million primarily related to a California state tax law

change, (iii) a benefit of $46 million related to the reversal of a valuation allowance against a deferred income tax asset

associated with the Company’s investment in Clearwire Corporation (“Clearwire”) and (iv) a charge of $15 million related

to the recording of a deferred income tax liability associated with a partnership basis difference.

Absent the impacts of the above items, the effective tax rates would have been 38.2%, 39.1% and 39.5% for 2014,

2013 and 2012, respectively.

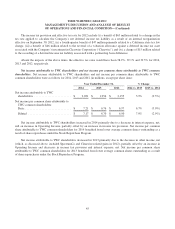

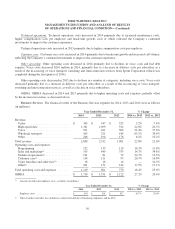

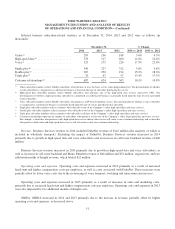

Net income attributable to TWC shareholders and net income per common share attributable to TWC common

shareholders. Net income attributable to TWC shareholders and net income per common share attributable to TWC

common shareholders were as follows for 2014, 2013 and 2012 (in millions, except per share data):

Year Ended December 31, % Change

2014 2013 2012 2014 vs. 2013 2013 vs. 2012

Net income attributable to TWC

shareholders ......................... $ 2,031 $ 1,954 $ 2,155 3.9% (9.3%)

Net income per common share attributable to

TWC common shareholders:

Basic ............................... $ 7.21 $ 6.76 $ 6.97 6.7% (3.0%)

Diluted ............................. $ 7.17 $ 6.70 $ 6.90 7.0% (2.9%)

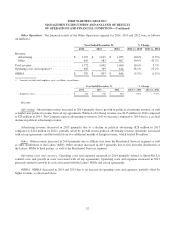

Net income attributable to TWC shareholders increased in 2014 primarily due to a decrease in interest expense, net,

and an increase in Operating Income, partially offset by an increase in income tax provision. Net income per common

share attributable to TWC common shareholders for 2014 benefited from lower average common shares outstanding as a

result of share repurchases under the Stock Repurchase Program.

Net income attributable to TWC shareholders decreased in 2013 primarily due to the decrease in other income, net

(which, as discussed above, included SpectrumCo and Clearwire-related gains in 2012), partially offset by an increase in

Operating Income and decreases in income tax provision and interest expense, net. Net income per common share

attributable to TWC common shareholders for 2013 benefited from lower average common shares outstanding as a result

of share repurchases under the Stock Repurchase Program.

45