Time Warner Cable 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

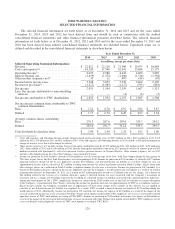

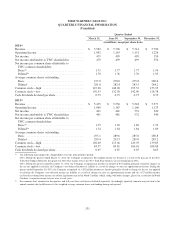

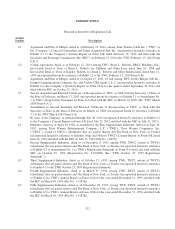

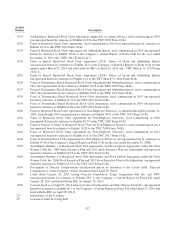

TIME WARNER CABLE INC.

QUARTERLY FINANCIAL INFORMATION

(Unaudited)

Quarter Ended

March 31, June 30, September 30, December 31,

(in millions, except per share data)

2014(a)

Revenue ....................................... $ 5,582 $ 5,726 $ 5,714 $ 5,790

Operating Income ............................... 1,092 1,163 1,151 1,226

Net income ..................................... 479 499 499 554

Net income attributable to TWC shareholders ......... 479 499 499 554

Net income per common share attributable to

TWC common shareholders:

Basic(b) ...................................... 1.71 1.77 1.77 1.96

Diluted(b) .................................... 1.70 1.76 1.76 1.95

Average common shares outstanding:

Basic ....................................... 277.8 278.8 279.8 280.6

Diluted ...................................... 281.8 282.4 283.5 284.2

Common stock—high ............................ 147.28 148.20 155.32 155.95

Common stock—low ............................. 130.53 132.58 142.90 128.78

Cash dividends declared per share ................... 0.75 0.75 0.75 0.75

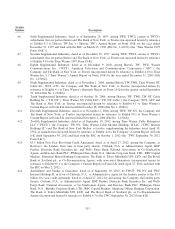

2013(a)

Revenue ....................................... $ 5,475 $ 5,550 $ 5,518 $ 5,577

Operating Income ............................... 1,060 1,187 1,160 1,173

Net income ..................................... 401 481 532 540

Net income attributable to TWC shareholders ......... 401 481 532 540

Net income per common share attributable to

TWC common shareholders:

Basic(b) ...................................... 1.35 1.65 1.86 1.92

Diluted(b) .................................... 1.34 1.64 1.84 1.89

Average common shares outstanding:

Basic ....................................... 295.1 289.6 285.0 280.8

Diluted ...................................... 299.4 293.3 289.0 285.2

Common stock—high ............................ 102.00 113.06 120.93 139.85

Common stock—low ............................. 84.57 89.81 106.01 108.88

Cash dividends declared per share ................... 0.65 0.65 0.65 0.65

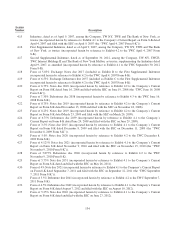

(a) The following items impact the comparability of results from period to period:

2014: During the quarter ended March 31, 2014, the Company recognized a $24 million income tax benefit as a result of the passage of the New

York State budget during the first quarter of 2014 that, in part, lowers the New York State business tax rate beginning in 2016.

2013: During the quarter ended December 31, 2013, the Company recognized an income tax benefit of $45 million primarily related to changes in

the tax rate applied to calculate the Company’s net deferred income tax liability as a result of changes to state tax apportionment factors. During the

quarter ended September 30, 2013, the Company recognized (i) a $32 million income tax benefit primarily related to changes in the tax rate applied

to calculate the Company’s net deferred income tax liability as a result of changes to state tax apportionment factors and (ii) a $27 million income

tax benefit resulting from income tax reform legislation enacted in North Carolina, which, along with other changes, phases in a reduction in North

Carolina’s corporate income tax rate over several years.

(b) Per common share amounts for the quarters and full years have each been calculated separately. Accordingly, quarterly amounts may not sum to the

annual amounts due to differences in the weighted-average common shares outstanding during each period.

131