Time Warner Cable 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

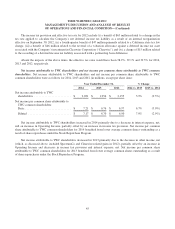

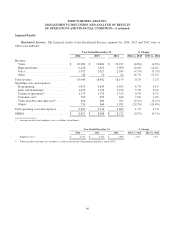

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

the network. In addition, TWC provides certain production and technical services to American Media Productions. As a

result of the launch of SportsNet LA, related revenue, including intersegment revenue, and expenses are included in the

Company’s Other Operations segment. The Company continues to seek distribution agreements for the carriage of

SportsNet LA by major distributors.

Competition

The operations of each of TWC’s reportable segments face intense competition, both from existing competitors and,

as a result of the rapid development of new technologies, services and products, from new entrants.

Residential Services Segment

TWC faces intense competition for residential customers from a variety of alternative communications, information

and entertainment delivery sources. TWC competes with incumbent local telephone companies and overbuilders across

each of its residential services. Some of these competitors offer a broad range of services with features and functions

comparable to those provided by TWC and in bundles similar to those offered by TWC, sometimes including wireless

service. Each of TWC’s residential services also faces competition from other companies that provide services on a stand-

alone basis. TWC’s residential video service faces competition from direct broadcast satellite services, and increasingly

from companies that deliver content to consumers over the Internet. TWC’s residential high-speed data service faces

competition from wireless Internet providers and direct broadcast satellite services. TWC’s residential voice service faces

competition from wireless voice providers, “over-the-top” phone services and other alternatives.

Business Services Segment

TWC faces significant competition as to each of its business services offerings. Its business high-speed data,

networking and voice services face competition from a variety of telecommunications carriers, including incumbent local

telephone companies. TWC’s cell tower backhaul service also faces competition from traditional telephone companies as

well as other telecommunications carriers, such as metro and regional fiber-based carriers. TWC’s business video service

faces competition from direct broadcast satellite providers. TWC also competes with cloud, hosting and related service

providers and application-service providers.

Other Operations Segment

TWC faces intense competition in its advertising business across many different platforms and from a wide range of

local and national competitors. Competition has increased and will likely continue to increase as new formats for

advertising seek to attract the same advertisers. TWC competes for advertising revenue against, among others, local

broadcast stations, national cable and broadcast networks, radio, newspapers, magazines and outdoor advertisers, as well

as online advertising companies.

Recent Developments

Common Stock Repurchase Program

In connection with the Company’s entry into the Merger Agreement, the Company suspended its common stock

repurchase program (the “Stock Repurchase Program”) on February 13, 2014. From the inception of the Stock Repurchase

Program in the fourth quarter of 2010 through February 12, 2014, the Company repurchased 92.9 million shares of TWC

common stock at an average price of $83.37 per share, or $7.744 billion in total. As of December 31, 2014, the Company

had $2.723 billion remaining under the Stock Repurchase Program authorization.

37