Time Warner Cable 2014 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

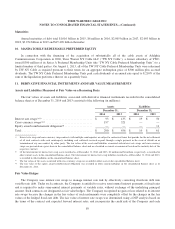

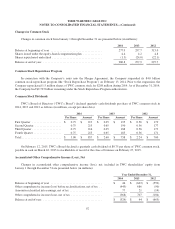

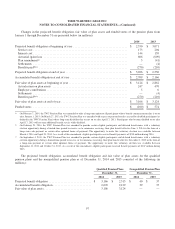

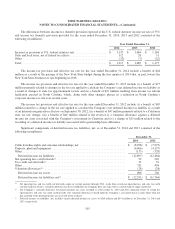

Changes in the projected benefit obligation, fair value of plan assets and funded status of the pension plans from

January 1 through December 31 are presented below (in millions):

2014 2013

Projected benefit obligation at beginning of year ..................................... $ 2,550 $ 3,071

Service cost ................................................................ 173 204

Interest cost ................................................................ 144 139

Actuarial (gain) loss ......................................................... 606 (609)

Plan amendment(a) ........................................................... 3 (41)

Settlements ................................................................ — (4)

Benefits paid(b)(c) ............................................................ (270) (210)

Projected benefit obligation at end of year .......................................... $ 3,206 $ 2,550

Accumulated benefit obligation at end of year ....................................... $ 2,709 $ 2,166

Fair value of plan assets at beginning of year ........................................ $ 3,124 $ 2,862

Actual return on plan assets ................................................... 247 470

Employer contributions ....................................................... 5 6

Settlements ................................................................ — (4)

Benefits paid(b)(c) ............................................................ (270) (210)

Fair value of plan assets at end of year ............................................. $ 3,106 $ 3,124

Funded status ................................................................ $ (100) $ 574

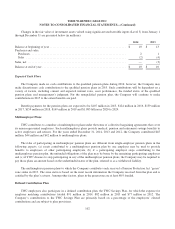

(a) On February 7, 2014, the TWC Pension Plan was amended to offer a lump sum option to all participants whose benefit commencement date is on or

after January 1, 2015. On March 27, 2013, the TWC Pension Plan was amended with respect to pension benefits accrued by disabled participants (as

defined in the TWC Pension Plan) whose long-term disability date occurs on or after April 17, 2013. Participants who become disabled on or after

April 17, 2013 will not earn additional benefit service while disabled.

(b) On February 21, 2014, the TWC Pension Plan was amended to provide certain eligible participants and deferred beneficiaries with a voluntary

election opportunity during a limited-time period to receive, or to commence receiving, their plan benefit effective June 1, 2014 in the form of a

lump sum cash payment or certain other optional forms of payment. The opportunity to make this voluntary election was available between

March 4, 2014 and April 24, 2014. As a result of this amendment, eligible participants received benefit payments of $210 million during 2014.

(c) On September 4, 2013, the TWC Pension Plan was amended to provide certain eligible participants and deferred beneficiaries with a voluntary

election opportunity during a limited-time period to receive, or to commence receiving, their plan benefit effective December 1, 2013 in the form of

a lump-sum payment or certain other optional forms of payment. The opportunity to make this voluntary election was available between

September 10, 2013 and October 31, 2013. As a result of this amendment, eligible participants received benefit payments of $167 million during

2013.

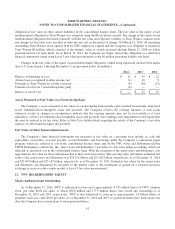

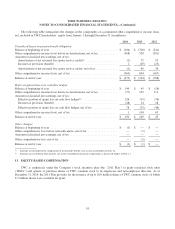

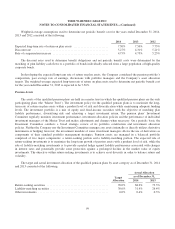

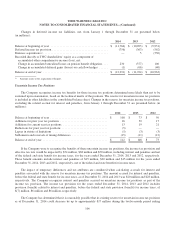

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for the qualified

pension plans and the nonqualified pension plan as of December 31, 2014 and 2013 consisted of the following (in

millions):

Qualified Pension Plans Nonqualified Pension Plan

December 31, December 31,

2014 2013 2014 2013

Projected benefit obligation ............................. $ 3,166 $ 2,513 $ 40 $ 37

Accumulated benefit obligation .......................... 2,670 2,129 39 37

Fair value of plan assets ................................ 3,106 3,124 — —

97