Time Warner Cable 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

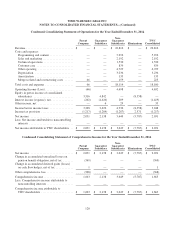

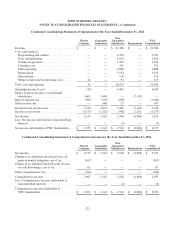

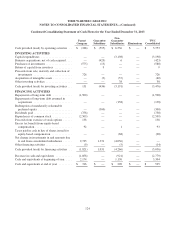

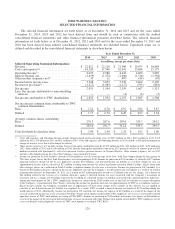

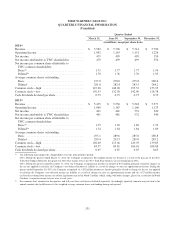

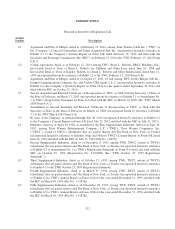

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Condensed Consolidating Statement of Cash Flows for the Year Ended December 31, 2012

Parent

Company

Guarantor

Subsidiary

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Cash provided (used) by operating activities . . $ (191) $ (603) $ 6,319 $ — $ 5,525

INVESTING ACTIVITIES

Capital expenditures ..................... — — (3,095) — (3,095)

Business acquisitions, net of cash acquired .... (1,350) — 10 — (1,340)

Purchases of investments .................. (150) (17) (40) — (207)

Return of capital from investees ............ — 1,112 88 — 1,200

Proceeds from sale, maturity and collection of

investments .......................... — 64 40 — 104

Acquisition of intangible assets ............. (3) — (34) — (37)

Investments in (distributions and sale proceeds

from) consolidated subsidiaries ........... (33) — (392) 425 —

Other investing activities .................. — — 30 — 30

Cash provided (used) by investing activities . . . (1,536) 1,159 (3,393) 425 (3,345)

FINANCING ACTIVITIES

Short-term borrowings, net ................ 392 — — (392) —

Proceeds from issuance of long-term debt .... 2,258 — — — 2,258

Repayments of long-term debt ............. (1,500) (600) — — (2,100)

Repayments of long-term debt assumed in

acquisitions .......................... — — (1,730) — (1,730)

Debt issuance costs ...................... (26) — — — (26)

Dividends paid .......................... (700) — — — (700)

Repurchases of common stock ............. (1,850) — — — (1,850)

Proceeds from exercise of stock options ...... 140 — — — 140

Excess tax benefit from equity-based

compensation ......................... 62 — 19 — 81

Taxes paid in cash in lieu of shares issued for

equity-based compensation .............. — — (45) — (45)

Acquisition of noncontrolling interest ........ — — (32) — (32)

Net change in investments in and amounts due

to and from consolidated subsidiaries ...... 769 44 (780) (33) —

Other financing activities .................. (16) — (33) — (49)

Cash used by financing activities ........... (471) (556) (2,601) (425) (4,053)

Increase (decrease) in cash and equivalents . . . (2,198) — 325 — (1,873)

Cash and equivalents at beginning of year .... 4,372 — 805 — 5,177

Cash and equivalents at end of year ......... $ 2,174 $ — $ 1,130 $ — $ 3,304

125