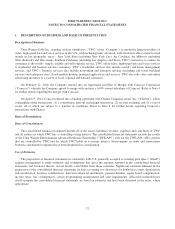

Time Warner Cable 2014 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

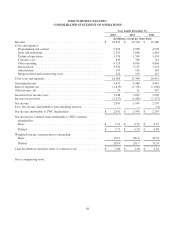

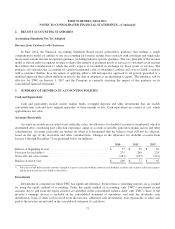

Property, Plant and Equipment

Property, plant and equipment are stated at cost, and depreciation on these assets is provided using the straight-line

method over their estimated useful lives. Costs associated with the construction of transmission and distribution facilities

are capitalized. With respect to customer premise equipment, which includes set-top boxes and high-speed data and

telephone modems, installation costs are capitalized only upon the initial deployment of these assets. All costs incurred in

subsequent disconnects and reconnects of previously installed customer premise equipment are expensed as incurred.

Standard capitalization rates are used to capitalize installation activities. Significant judgment is involved in the

development of these capitalization standards, including the average time required to perform an installation and the

determination of the nature and amount of indirect costs to be capitalized. The capitalization standards are reviewed at

least annually and adjusted, if necessary, based on comparisons to actual costs incurred. Generally, expenditures for

tangible fixed assets having a useful life of greater than one year are capitalized. Capitalized costs include direct material,

labor and overhead, as well as interest. The costs associated with the repair and maintenance of existing tangible fixed

assets are expensed as incurred.

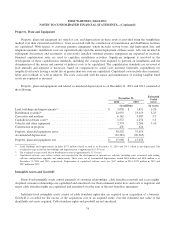

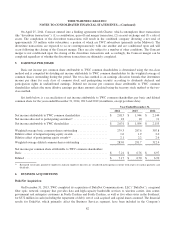

Property, plant and equipment and related accumulated depreciation as of December 31, 2014 and 2013 consisted of

the following:

December 31, Estimated

Useful

Lives2014 2013

(in millions) (in years)

Land, buildings and improvements(a) ............................... $ 2,038 $ 1,851 1-20

Distribution systems(b) ........................................... 24,951 23,119 3-25

Converters and modems ......................................... 6,141 5,687 3-5

Capitalized software costs(c) ...................................... 2,572 2,252 3-5

Vehicles and other equipment ..................................... 2,374 2,286 3-10

Construction in progress ......................................... 476 424

Property, plant and equipment, gross ............................... 38,552 35,619

Accumulated depreciation ........................................ (22,562) (20,563)

Property, plant and equipment, net ................................. $ 15,990 $ 15,056

(a) Land, buildings and improvements includes $173 million related to land as of December 31, 2014 and 2013, which is not depreciated. The

weighted-average useful life for buildings and improvements is approximately 17.59 years.

(b) The weighted-average useful life for distribution systems is approximately 13.13 years.

(c) Capitalized software costs reflect certain costs incurred for the development of internal use software, including costs associated with coding,

software configuration, upgrades and enhancements. These costs, net of accumulated depreciation, totaled $803 million and $801 million as of

December 31, 2014 and 2013, respectively. Depreciation of capitalized software costs was $317 million in 2014, $270 million in 2013 and

$237 million in 2012.

Intangible Assets and Goodwill

Finite-lived intangible assets consist primarily of customer relationships, cable franchise renewals and access rights.

Acquired customer relationships are capitalized and amortized over their estimated useful lives and costs to negotiate and

renew cable franchise rights are capitalized and amortized over the term of the new franchise agreement.

Indefinite-lived intangible assets consist of cable franchise rights that are acquired in an acquisition of a business.

Goodwill is recorded for the excess of the acquisition cost of an acquired entity over the estimated fair value of the

identifiable net assets acquired. Cable franchise rights and goodwill are not amortized.

74