Time Warner Cable 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

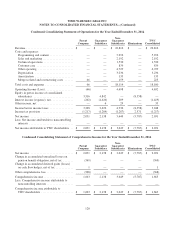

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Noncontrolling Interests

During the fourth quarter of 2012, TWC acquired the remaining 45.81% noncontrolling interest in Erie

Telecommunications, Inc. (“Erie”) for $32 million and, as a result, TWC owns 100% of Erie. This acquisition was

recorded as an equity transaction and is reflected as a financing activity in the consolidated statement of cash flows. As a

result, the carrying balance of this noncontrolling interest of $5 million was eliminated, and the remaining $27 million,

representing the difference between the purchase price and carrying balance, was recorded as a reduction to additional

paid-in capital.

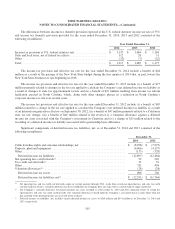

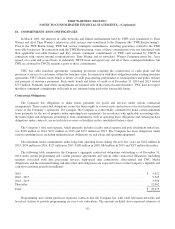

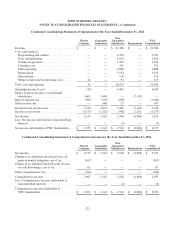

Interest Expense, Net

Interest expense, net, for the years ended December 31, 2014, 2013 and 2012 consisted of the following (in millions):

Year Ended December 31,

2014 2013 2012

Interest expense .............................................. $ (1,419) $ (1,555) $ (1,614)

Interest income ............................................... — 3 8

Interest expense, net ........................................... $ (1,419) $ (1,552) $ (1,606)

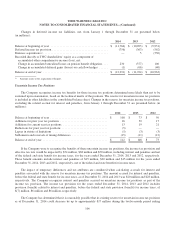

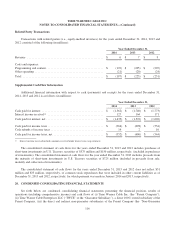

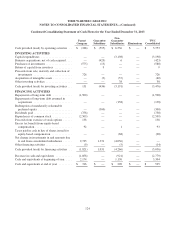

Other Income, Net

Other income, net, for the years ended December 31, 2014, 2013 and 2012 consisted of the following (in millions):

Year Ended December 31,

2014 2013 2012

Income from equity-method investments, net(a) ...................... $ 33 $ 19 $ 454

Gain (loss) on equity award reimbursement obligation to

Time Warner ............................................... 1 (10) (9)

Gain on sale of investment in Clearwire ........................... — — 64

Other investment losses(b) ....................................... — — (12)

Other ....................................................... 1 2 —

Other income, net ............................................. $ 35 $ 11 $ 497

(a) Income from equity-method investments, net, in 2012 primarily consists of a pretax gain of $430 million associated with SpectrumCo’s sale of its

advanced wireless spectrum licenses to Verizon Wireless (refer to Note 7 for further details).

(b) Other investment losses in 2012 represents an impairment of the Company’s investment in Canoe Ventures LLC (“Canoe”), an equity-method

investee. The impairment was recognized as a result of Canoe’s announcement during the first quarter of 2012 of a restructuring that significantly

curtailed its operations.

115