Time Warner Cable 2014 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

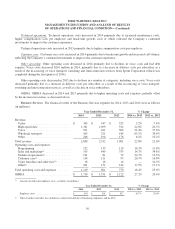

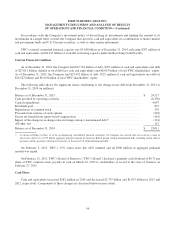

requirements. Cash paid for income taxes, net, for 2013 was impacted by the extension of 2012 bonus depreciation

deductions of 50% of the cost of the Company’s qualified capital expenditures for 2013, which largely offset the

Company’s increase in cash paid for income taxes, net, in 2013 from the reversal of bonus depreciation benefits recorded

in prior years. Cash paid for income taxes, net, in 2012 benefited from a number of deductions (primarily (i) the usage of

Insight’s net operating loss carryforwards, (ii) other Insight-related items, (iii) a taxable loss on the sale of the Clearwire

investment and (iv) a tax deduction related to reserves from the formation of an insurance subsidiary in connection with a

2012 internal reorganization, partially offset by the fourth-quarter 2012 income tax payments on the gain on the sale of

SpectrumCo’s licenses) that did not recur in 2013 and, as a result, the Company’s cash paid for income taxes, net,

increased in 2013 compared to 2012.

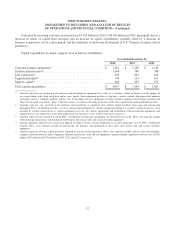

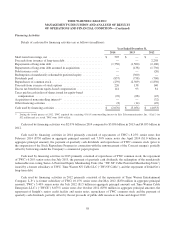

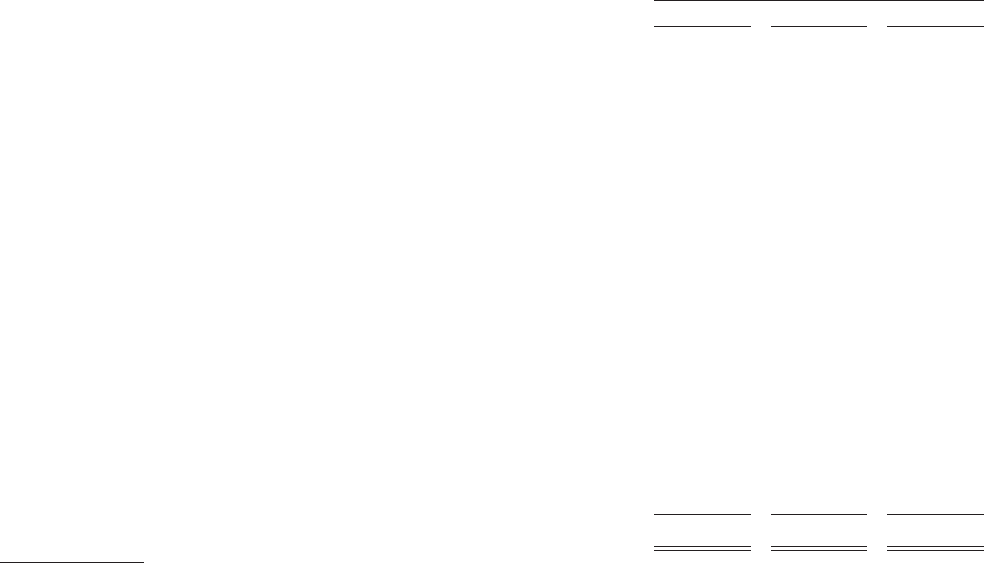

Investing Activities

Details of cash used by investing activities are as follows (in millions):

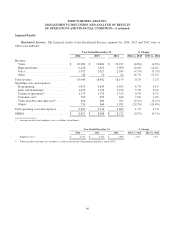

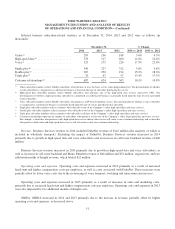

Year Ended December 31,

2014 2013 2012

Capital expenditures .............................................. $ (4,097) $ (3,198) $ (3,095)

Business acquisitions, net of cash acquired:

DukeNet acquisition ............................................ — (423) —

Insight acquisition .............................................. — — (1,339)

All other ...................................................... — — (1)

Purchases of investments:

Short-term investments in U.S. Treasury securities .................... — (575) (150)

Loan to Sterling Entertainment Enterprises, LLC ...................... — — (40)

All other ...................................................... (2) (13) (17)

Return of capital from investees:

SpectrumCo(a) ................................................. — 7 1,112

Sterling Entertainment Enterprises, LLC(b) ........................... — — 88

All other ...................................................... — 2 —

Proceeds from sale, maturity and collection of investments:

Maturity of short-term investments in U.S. Treasury securities ........... — 725 —

Proceeds from sale of investment in Clearwire ........................ — — 64

Repayment of loan to Sterling Entertainment Enterprises, LLC ........... — — 40

All other ...................................................... 19 1 —

Acquisition of intangible assets ...................................... (39) (40) (37)

Other investing activities ........................................... 27 38 30

Cash used by investing activities ..................................... $ (4,092) $ (3,476) $ (3,345)

(a) 2012 amount represents the proceeds from SpectrumCo’s sale of advanced wireless spectrum licenses.

(b) Amount represents distributions received from Sterling Entertainment Enterprises, LLC (doing business as SportsNet New York), an equity-method

investee.

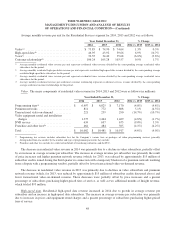

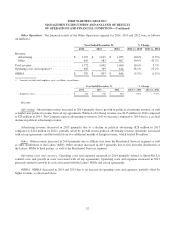

Cash used by investing activities increased from $3.476 billion in 2013 to $4.092 billion in 2014, principally due to

an increase in capital expenditures and the 2013 maturities of short-term investments in U.S. Treasury securities (net of

purchases), partially offset by a decrease in business acquisitions, net of cash acquired. The increase in capital

expenditures was primarily due to the Company’s investments to improve network reliability, upgrade older customer

premise equipment and expand its network to additional residences, commercial buildings and cell towers.

56