Time Warner Cable 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

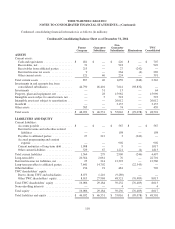

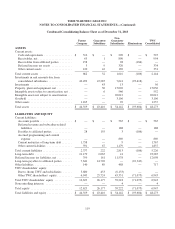

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

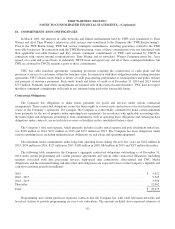

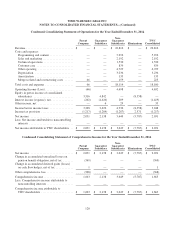

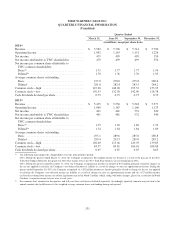

Condensed Consolidating Statement of Operations for the Year Ended December 31, 2013

Parent

Company

Guarantor

Subsidiary

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Revenue ................................. $ — $ — $ 22,120 $ — $ 22,120

Costs and expenses:

Programming and content ................. — — 4,950 — 4,950

Sales and marketing ...................... — — 2,048 — 2,048

Technical operations ...................... — — 1,500 — 1,500

Customer care ........................... — — 766 — 766

Other operating .......................... — — 4,876 — 4,876

Depreciation ............................ — — 3,155 — 3,155

Amortization ............................ — — 126 — 126

Merger-related and restructuring costs ........ — 3 116 — 119

Total costs and expenses .................... — 3 17,537 — 17,540

Operating Income (Loss) .................... — (3) 4,583 — 4,580

Equity in pretax income of consolidated

subsidiaries ............................. 3,273 3,659 — (6,932) —

Interest expense, net ........................ (235) (501) (816) — (1,552)

Other income (expense), net .................. 1 (5) 15 — 11

Income before income taxes .................. 3,039 3,150 3,782 (6,932) 3,039

Income tax provision ....................... (1,085) (1,139) (973) 2,112 (1,085)

Net income ............................... 1,954 2,011 2,809 (4,820) 1,954

Less: Net income attributable to noncontrolling

interests ................................ — — — — —

Net income attributable to TWC shareholders .... $ 1,954 $ 2,011 $ 2,809 $ (4,820) $ 1,954

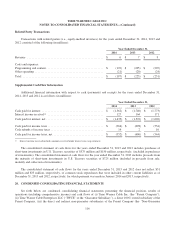

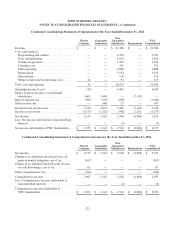

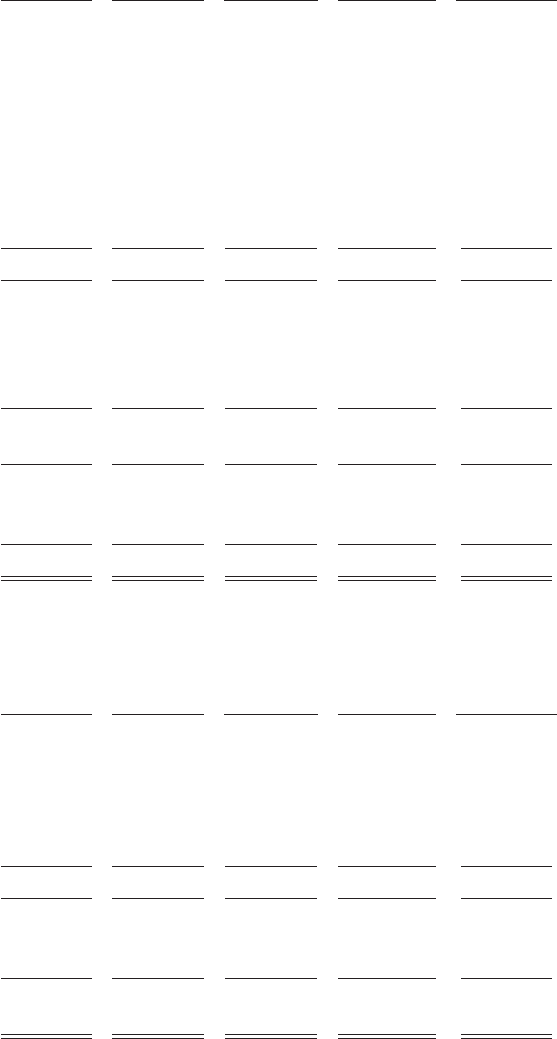

Condensed Consolidating Statement of Comprehensive Income for the Year Ended December 31, 2013

Parent

Company

Guarantor

Subsidiary

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

Net income ............................... $ 1,954 $ 2,011 $ 2,809 $ (4,820) $ 1,954

Change in accumulated unrealized losses on

pension benefit obligation, net of tax ......... 604 — — — 604

Change in accumulated deferred gains (losses)

on cash flow hedges, net of tax ............. 104 — — — 104

Other changes ............................. (1) — (1) 1 (1)

Other comprehensive income (loss) ............ 707 — (1) 1 707

Comprehensive income ..................... 2,661 2,011 2,808 (4,819) 2,661

Less: Comprehensive income attributable to

noncontrolling interests ................... — — — — —

Comprehensive income attributable to

TWC shareholders ....................... $ 2,661 $ 2,011 $ 2,808 $ (4,819) $ 2,661

121