Time Warner Cable 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

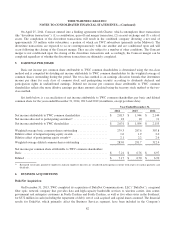

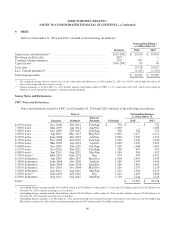

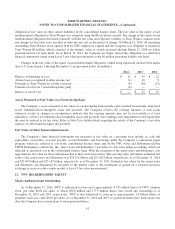

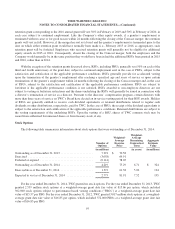

9. DEBT

Debt as of December 31, 2014 and 2013 consisted of the following (in millions):

Outstanding Balance

as of December 31,

Maturity 2014 2013

Senior notes and debentures(a) ....................................... 2015-2042 $ 23,126 $ 25,003

Revolving credit facility ........................................... 2017 — —

Commercial paper program ......................................... 2017 507 —

Capital leases .................................................... 2016-2042 85 49

Total debt ....................................................... 23,718 25,052

Less: Current maturities(b) .......................................... (1,017) (1,767)

Total long-term debt .............................................. $ 22,701 $ 23,285

(a) The weighted-average effective interest rate for the senior notes and debentures as of December 31, 2014 was 5.953% and includes the effects of

interest rate swaps and cross-currency swaps.

(b) Current maturities as of December 31, 2014 include amounts outstanding under (a) TWC’s 3.5% senior notes due 2015, which were repaid on

February 2, 2015, and (b) the Company’s commercial paper program.

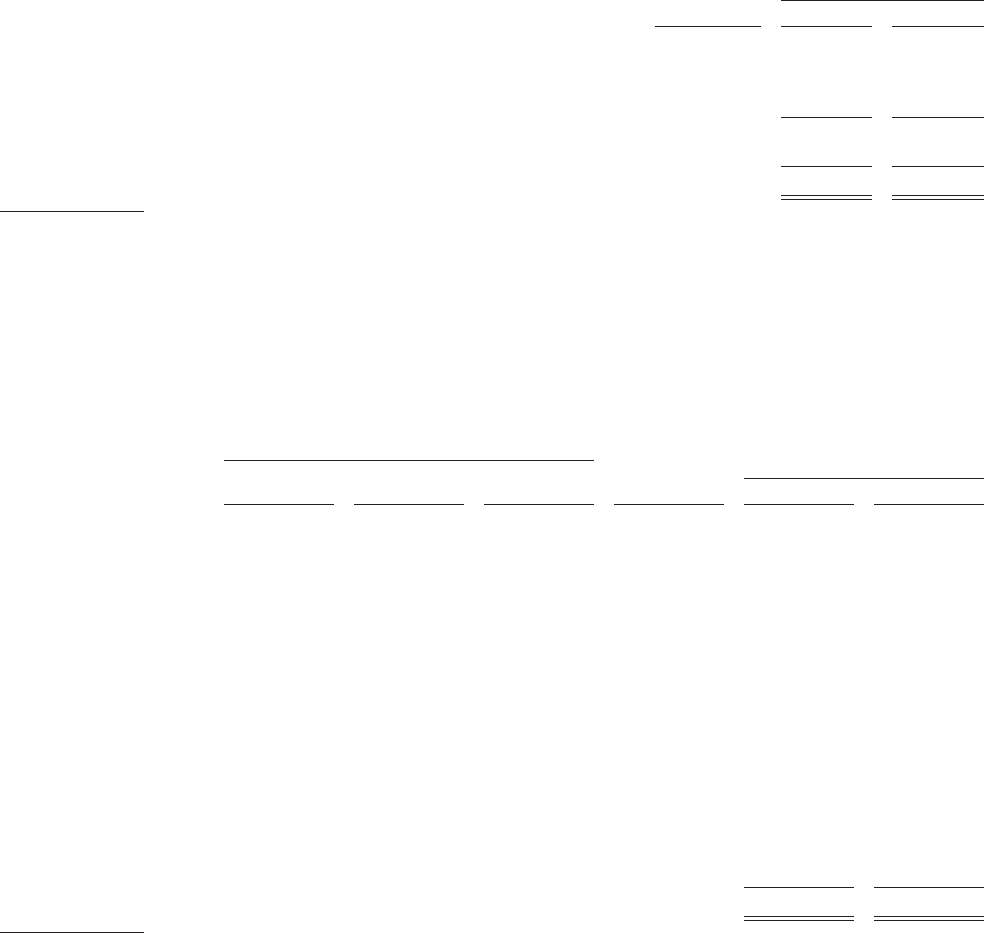

Senior Notes and Debentures

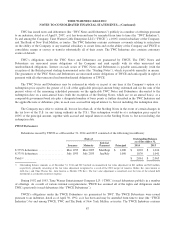

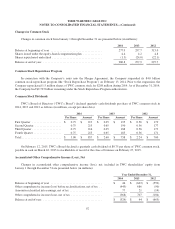

TWC Notes and Debentures

Notes and debentures issued by TWC as of December 31, 2014 and 2013 consisted of the following (in millions):

Date of Outstanding Balance

as of December 31,

Issuance Maturity

Interest

Payment Principal 2014 2013

8.250% notes ......... Nov2008 Feb 2014 Feb/Aug $ 750 $ — $ 752

7.500% notes ......... Mar2009 Apr 2014 Apr/Oct 1,000 — 1,006

3.500% notes ......... Dec2009 Feb 2015 Feb/Aug 500 501 512

5.850% notes ......... Apr2007 May 2017 May/Nov 2,000 2,077 2,111

6.750% notes ......... June 2008 July 2018 Jan/July 2,000 1,993 1,975

8.750% notes ......... Nov2008 Feb 2019 Feb/Aug 1,250 1,242 1,240

8.250% notes ......... Mar2009 Apr 2019 Apr/Oct 2,000 1,996 1,969

5.000% notes ......... Dec2009 Feb 2020 Feb/Aug 1,500 1,484 1,481

4.125% notes ......... Nov2010 Feb 2021 Feb/Aug 700 697 697

4.000% notes ......... Sep2011 Sep 2021 Mar/Sep 1,000 994 993

5.750% notes(a) ........ May2011 June 2031 June 974 970 1,032

6.550% debentures ..... Apr2007 May 2037 May/Nov 1,500 1,493 1,493

7.300% debentures ..... June 2008 July 2038 Jan/July 1,500 1,497 1,496

6.750% debentures ..... June 2009 June 2039 June/Dec 1,500 1,465 1,463

5.875% debentures ..... Nov2010 Nov 2040 May/Nov 1,200 1,179 1,179

5.500% debentures ..... Sep2011 Sep 2041 Mar/Sep 1,250 1,230 1,230

5.250% notes(b) ....... June 2012 July 2042 July 1,012 1,003 1,066

4.500% debentures ..... Aug2012 Sep 2042 Mar/Sep 1,250 1,244 1,243

Total(c) .............. $ 21,065 $ 22,938

(a) Outstanding balance amounts include £623 million valued at $970 million as of December 31, 2014 and £623 million valued at $1.032 billion as of

December 31, 2013 using the exchange rate at each date.

(b) Outstanding balance amounts include £644 million valued at $1.003 billion as of December 31, 2014 and £644 million valued at $1.066 billion as of

December 31, 2013 using the exchange rate at each date.

(c) Outstanding balance amounts as of December 31, 2014 and 2013 include the estimated fair value of net interest rate swap assets of $74 million and

$85 million, respectively, and exclude an unamortized discount of $145 million and $158 million, respectively.

86