Time Warner Cable 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

retention grant corresponding to the 2016 annual grant will vest 50% in February of 2019 and 50% in February of 2020, in

each case subject to continued employment. Like the Company’s other equity awards, if a grantee’s employment is

terminated without cause or for good reason within 24 months following the closing of the Comcast merger, the retention

grants will vest in full. However, if the merger has not yet closed and the grantee’s employment is terminated prior to the

date on which either retention grant would have normally been made (i.e., February 2015 or 2016, as appropriate), such

retention grant will be forfeited. Employees who received retention grants will generally not be eligible for additional

equity awards in 2015 or 2016. Consequently, absent the closing of the Comcast merger, both the employees and the

Company would generally be in the same position they would have been in had the additional RSUs been granted in 2015

and 2016, rather than in 2014.

With the exception of the retention grants discussed above, RSUs, including PBUs, generally vest 50% on each of the

third and fourth anniversary of the grant date, subject to continued employment and, in the case of PBUs, subject to the

satisfaction and certification of the applicable performance conditions. RSUs generally provide for accelerated vesting

upon the termination of the grantee’s employment after reaching a specified age and years of service or upon certain

terminations of the grantee’s employment within 24 months following the closing of the Comcast merger and, in the case

of PBUs, subject to the satisfaction and certification of the applicable performance conditions. PBUs are subject to

forfeiture if the applicable performance condition is not satisfied. RSUs awarded to non-employee directors are not

subject to vesting or forfeiture restrictions and the shares underlying the RSUs will generally be issued in connection with

a director’s termination of service as a director. Pursuant to the directors’ compensation program, certain directors with

more than three years of service on TWC’s Board have elected an in-service vesting period for their RSU awards. Holders

of RSUs are generally entitled to receive cash dividend equivalents or retained distributions related to regular cash

dividends or other distributions, respectively, paid by TWC. In the case of PBUs, the receipt of the dividend equivalents is

subject to the satisfaction and certification of the applicable performance conditions. Retained distributions are subject to

the vesting requirements of the underlying RSUs. Upon the vesting of a RSU, shares of TWC common stock may be

issued from authorized but unissued shares or from treasury stock, if any.

Stock Options

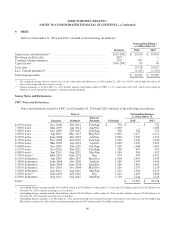

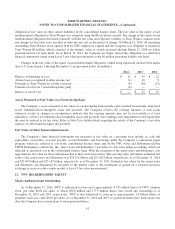

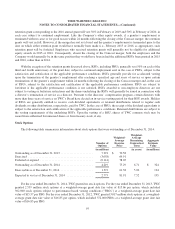

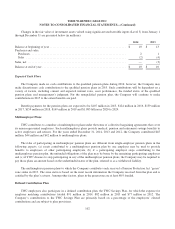

The following table summarizes information about stock options that were outstanding as of December 31, 2014:

Number of

Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(in millions) (in years) (in millions)

Outstanding as of December 31, 2013 ...................... 7.991 $ 70.58

Exercised ............................................ (3.658) 64.91

Forfeited or expired .................................... (0.114) 78.05

Outstanding as of December 31, 2014 ...................... 4.219 75.29 6.71 $ 324

Exercisable as of December 31, 2014 ...................... 1.372 61.38 5.02 124

Expected to vest as of December 31, 2014 .................. 2.775 81.91 7.52 195

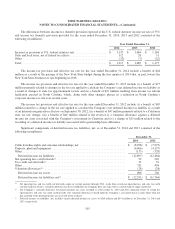

For the year ended December 31, 2014, TWC granted no stock options. For the year ended December 31, 2013, TWC

granted 2.539 million stock options at a weighted-average grant date fair value of $15.66 per option, which included

302,000 stock options subject to performance-based vesting conditions (“PBOs”) at a weighted-average grant date fair

value of $15.57 per PBO. For the year ended December 31, 2012, TWC granted 3.017 million stock options at a weighted-

average grant date fair value of $16.85 per option, which included 372,000 PBOs at a weighted-average grant date fair

value of $16.85 per PBO.

95