Time Warner Cable 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Clearwire

On September 13, 2012, the Company exchanged all of its beneficially owned shares of Class B common stock of

Clearwire Corporation (“Clearwire”) together with all of its beneficially owned Class B common units of Clearwire

Communications LLC for shares of Class A common stock of Clearwire. On September 27, 2012, the Company sold these

shares of Class A common stock for $64 million in cash. The sale resulted in a pretax gain of $64 million, which is

included in other income, net, in the consolidated statement of operations for the year ended December 31, 2012. In

addition, during the year ended December 31, 2012, the Company recorded an income tax benefit of $19 million primarily

related to the sale of Clearwire’s Class A common stock. The income tax benefit included the reversal of a $46 million

valuation allowance against a deferred income tax asset associated with the Company’s investment in Clearwire, which

had been established due to the uncertainty of realizing the full benefit of such asset. The Company reversed the valuation

allowance as a result of its ability to fully realize the capital losses from the sale of its Clearwire interests by offsetting

capital gains related to SpectrumCo’s sale of its spectrum licenses.

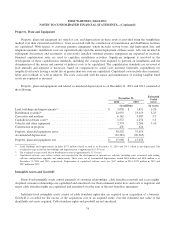

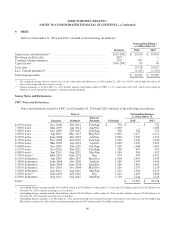

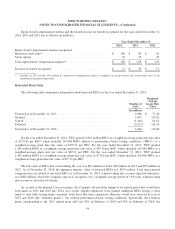

8. INTANGIBLE ASSETS AND GOODWILL

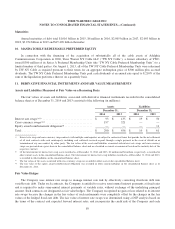

Intangible assets and related accumulated amortization as of December 31, 2014 and 2013 consisted of the following

(in millions):

December 31, 2014 December 31, 2013

Gross

Accumulated

Amortization Net Gross

Accumulated

Amortization Net

Intangible assets subject to

amortization:

Customer relationships ........ $ 600 $ (262) $ 338 $ 531 $ (167) $ 364

Cable franchise renewals and

access rights .............. 297 (130) 167 287 (120) 167

Other ...................... 42 (24) 18 38 (17) 21

Total ...................... $ 939 $ (416) $ 523 $ 856 $ (304) $ 552

Intangible assets not subject to

amortization:

Cable franchise rights ......... $ 26,934 $ (922) $ 26,012 $ 26,934 $ (922) $ 26,012

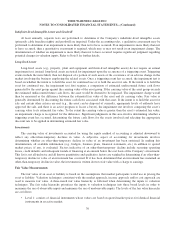

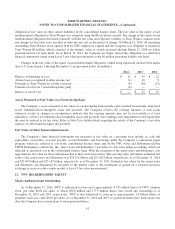

The Company recorded amortization expense of $135 million in 2014, $126 million in 2013 and $110 million in

2012. Based on the remaining carrying value of intangible assets subject to amortization as of December 31, 2014,

amortization expense is expected to be $131 million in 2015, $127 million in 2016, $123 million in 2017, $45 million in

2018 and $26 million in 2019. These amounts may vary as acquisitions and dispositions occur in the future.

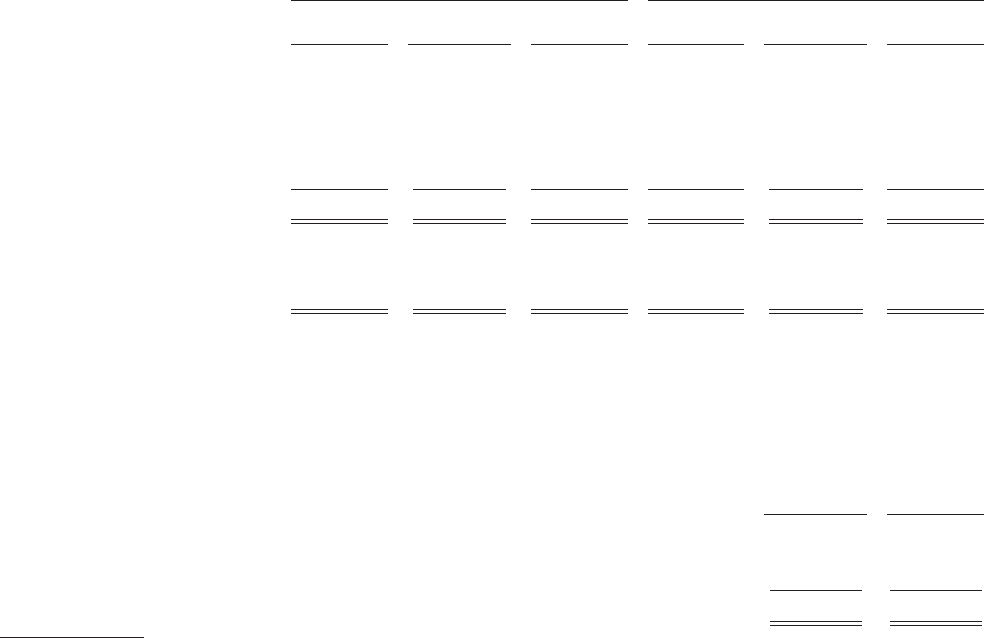

Changes in the carrying value of goodwill from January 1 through December 31 are presented below (in millions):

2014 2013

Balance at beginning of year ................................................... $ 3,196 $ 2,889

Acquisition of DukeNet(a) ..................................................... (61) 310

Other changes and adjustments ................................................. 2 (3)

Balance at end of year(b) ....................................................... $ 3,137 $ 3,196

(a) During the first quarter of 2014, the Company finalized its fair value estimates for certain long-lived assets (e.g., primarily property, plant and

equipment and finite-lived intangible assets) acquired in the acquisition of DukeNet resulting in a net $61 million adjustment to goodwill, which was

allocated to each reporting unit based upon relative fair value as described below.

(b) There were no accumulated goodwill impairment charges as of December 31, 2014 and 2013.

84