Time Warner Cable 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

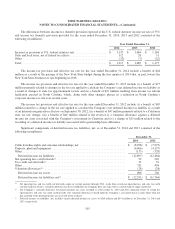

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

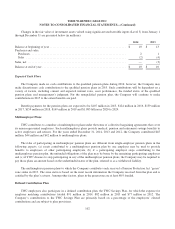

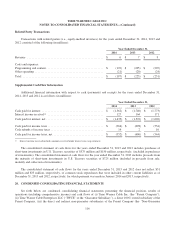

December 31, 2015 related to various ongoing audits and settlement discussions with the Internal Revenue Service (the

“IRS”) and various state and local jurisdictions.

If the Company were to recognize the benefits of these uncertain income tax positions upon a favorable resolution of

these matters, the income tax provision and effective tax rate could be impacted by up to approximately $12 million,

including interest and penalties and net of the federal and state benefit for income taxes. This benefit amount includes

interest and penalties of approximately $6 million, net of the federal and state benefit for income taxes. The Company

otherwise does not currently anticipate that its reserve for uncertain income tax positions as of December 31, 2014 will

significantly increase or decrease during the twelve-month period ended December 31, 2015; however, various events

could cause the Company’s current expectations to change in the future.

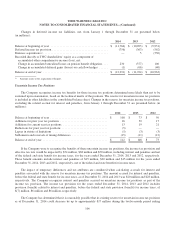

In September 2014, the IRS examination of the Company’s income tax returns for 2005 to 2007, which are periods

prior to TWC’s separation from Time Warner in March 2009 (the “Separation”), was settled with the exception of an

immaterial item that has been referred to the IRS Appeals Division. In August 2014, the IRS examination of the

Company’s 2009 and 2010 income tax returns for periods after the Separation was also settled. The resolution of these

examinations did not have a material impact on the Company’s consolidated financial position or results of operations. In

June 2014, the IRS started the examination of the Company’s 2008 and 2009 income tax returns for periods prior to the

Separation. In December 2014, the IRS also started the examination of the Company’s 2011 and 2012 income tax returns.

The Company does not anticipate that these examinations will have a material impact on the Company’s consolidated

financial position or results of operations. In addition, the Company is also subject to ongoing examinations of the

Company’s tax returns by state and local tax authorities for various periods. Activity related to these state and local

examinations did not have a material impact on the Company’s consolidated financial position or results of operations in

2014, nor does the Company anticipate a material impact in the future.

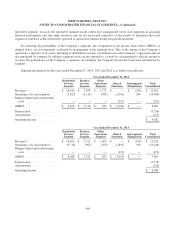

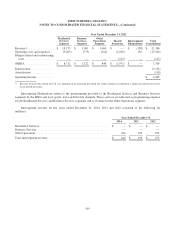

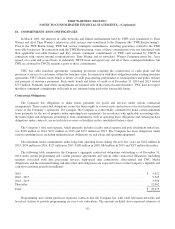

17. SEGMENT INFORMATION

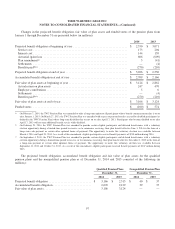

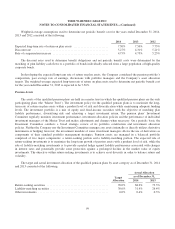

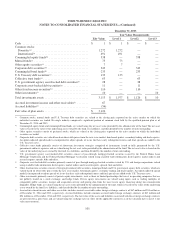

The Company classifies its operations into the following three reportable segments, which have been determined

based on how management evaluates and manages the business:

• Residential Services, which principally consists of video, high-speed data and voice services provided to

residential customers as well as other residential services, including security and home management services.

• Business Services, which principally consists of data, video and voice services provided to business customers as

well as other business services, including enterprise-class, cloud-enabled hosting, managed applications and

services.

• Other Operations, which principally consists of (i) Time Warner Cable Media (“TWC Media”), the advertising

sales arm of TWC, (ii) TWC-owned and/or operated regional sports networks (“RSNs”) and local sports, news

and lifestyle channels (e.g., Time Warner Cable News NY1) and (iii) other operating revenue and costs, including

those derived from the Advance/Newhouse Partnership and home shopping network-related services. The

business units reflected in the Other Operations segment individually do not meet the thresholds to be reported as

separate reportable segments.

In addition to the above reportable segments, the Company has shared functions (referred to as “Shared Functions”)

that include activities not attributable to a specific reportable segment. Shared Functions consists of operating costs and

expenses associated with broad “corporate” functions (e.g., accounting and finance, information technology, executive

management, legal and human resources) or functions supporting more than one reportable segment that are centrally

managed (e.g., facilities, network operations, vehicles and procurement) as well as other activities not attributable to a

107