Time Warner Cable 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

In accordance with the Company’s investment policy of diversifying its investments and limiting the amount of its

investments in a single entity or fund, the Company may invest its cash and equivalents in a combination of money market

and government funds and U.S. Treasury securities, as well as other similar instruments.

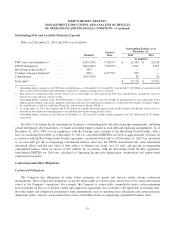

TWC’s unused committed financial capacity was $3.640 billion as of December 31, 2014, reflecting $707 million of

cash and equivalents and $2.933 billion of available borrowing capacity under the Revolving Credit Facility.

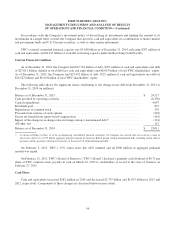

Current Financial Condition

As of December 31, 2014, the Company had $23.718 billion of debt, $707 million of cash and equivalents (net debt

of $23.011 billion, defined as total debt less cash and equivalents) and $8.013 billion of total TWC shareholders’ equity.

As of December 31, 2013, the Company had $25.052 billion of debt, $525 million of cash and equivalents (net debt of

$24.527 billion) and $6.943 billion of total TWC shareholders’ equity.

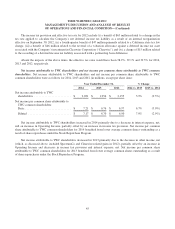

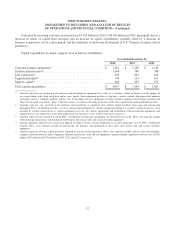

The following table shows the significant items contributing to the change in net debt from December 31, 2013 to

December 31, 2014 (in millions):

Balance as of December 31, 2013 .......................................................... $ 24,527

Cash provided by operating activities ....................................................... (6,350)

Capital expenditures .................................................................... 4,097

Dividends paid ......................................................................... 857

Repurchases of common stock ............................................................ 259

Proceeds from exercise of stock options ..................................................... (226)

Excess tax benefit from equity-based compensation ........................................... (141)

Impact of the change in exchange rates on foreign currency denominated debt(a) ..................... (124)

All other, net .......................................................................... 112

Balance as of December 31, 2014 .......................................................... $ 23,011

(a) As discussed further in Note 11 to the accompanying consolidated financial statements, the Company has entered into cross-currency swaps to

effectively convert its £1.275 billion aggregate principal amount of fixed-rate British pound sterling denominated debt, including annual interest

payments and the payment of principal at maturity, to fixed-rate U.S. dollar denominated debt.

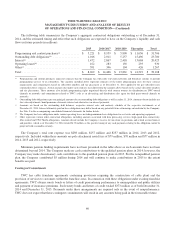

On February 2, 2015, TWC’s 3.5% senior notes due 2015 matured and all $500 million in aggregate principal

amount was repaid.

On February 12, 2015, TWC’s Board of Directors (“TWC’s Board”) declared a quarterly cash dividend of $0.75 per

share of TWC common stock, payable in cash on March 16, 2015 to stockholders of record at the close of business on

February 27, 2015.

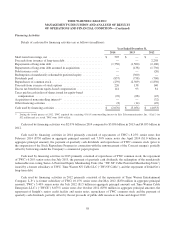

Cash Flows

Cash and equivalents increased $182 million in 2014 and decreased $2.779 billion and $1.873 billion in 2013 and

2012, respectively. Components of these changes are discussed below in more detail.

54