Time Warner Cable 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

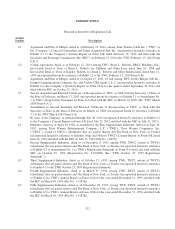

Exhibit

Number Description

4.6 Sixth Supplemental Indenture, dated as of September 29, 1997, among TWE, TWCI, certain of TWCI’s

subsidiaries that are parties thereto and The Bank of New York, as Trustee (incorporated herein by reference

to Exhibit 4.7 to Historic TW Inc.’s (“Historic TW”) Annual Report on Form 10-K for the year ended

December 31, 1997 and filed with the SEC on March 25, 1998 (File No. 1-12259) (the “Time Warner 1997

Form 10-K”)).

4.7 Seventh Supplemental Indenture, dated as of December 29, 1997, among TWE, TWCI, certain of TWCI’s

subsidiaries that are parties thereto and The Bank of New York, as Trustee (incorporated herein by reference

to Exhibit 4.8 to the Time Warner 1997 Form 10-K).

4.8 Eighth Supplemental Indenture, dated as of December 9, 2003, among Historic TW, TWE, Warner

Communications Inc. (“WCI”), American Television and Communications Corporation (“ATC”), the

Company and The Bank of New York, as Trustee (incorporated herein by reference to Exhibit 4.10 to Time

Warner Inc.’s (“Time Warner”) Annual Report on Form 10-K for the year ended December 31, 2003 (File

No. 1-15062)).

4.9 Ninth Supplemental Indenture, dated as of November 1, 2004, among Historic TW, TWE, Time Warner NY

Cable Inc., WCI, ATC, the Company and The Bank of New York, as Trustee (incorporated herein by

reference to Exhibit 4.1 to Time Warner’s Quarterly Report on Form 10-Q for the quarter ended September

30, 2004 (File No. 1-15062)).

4.10 Tenth Supplemental Indenture, dated as of October 18, 2006, among Historic TW, TWE, TW NY Cable

Holding Inc. (“TW NY”), Time Warner NY Cable LLC (“TW NY Cable”), the Company, WCI, ATC and

The Bank of New York, as Trustee (incorporated herein by reference to Exhibit 4.1 to Time Warner’s

Current Report on Form 8-K dated and filed October 18, 2006 (File No. 1-15062)).

4.11 Eleventh Supplemental Indenture, dated as of November 2, 2006, among TWE, TW NY, the Company and

The Bank of New York, as Trustee (incorporated herein by reference to Exhibit 99.1 to Time Warner’s

Current Report on Form 8-K dated and filed November 2, 2006 (File No. 1-15062)).

4.12 Twelfth Supplemental Indenture, dated as of September 30, 2012, among Time Warner Cable Enterprises

LLC (“TWCE”), the Company, TW NY, Time Warner Cable Internet Holdings II LLC (“TWC Internet

Holdings II”) and The Bank of New York Mellon, as trustee, supplementing the Indenture dated April 30,

1992, as amended (incorporated herein by reference to Exhibit 4.2 to the Company’s Current Report on Form

8-K dated September 30, 2012 and filed with the SEC on October 1, 2012 (the “TWC September 30, 2012

Form 8-K”)).

4.13 $3.5 billion Five-Year Revolving Credit Agreement, dated as of April 27, 2012, among the Company, as

Borrower, the Lenders from time to time party thereto, Citibank, N.A. as Administrative Agent, BNP

Paribas, Deutsche Bank Securities Inc. and Wells Fargo Bank, National Association, as Co-Syndication

Agents, and Barclays Bank PLC, JPMorgan Chase Bank, N.A., Mizuho Corporate Bank, LTD., RBC Capital

Markets, Sumitomo Mitsui Banking Corporation, The Bank of Tokyo-Mitsubishi UFJ, LTD. and The Royal

Bank of Scotland plc, as Co-Documentation Agents, with associated Guarantees (incorporated herein by

reference to Exhibit 99.1 to the Company’s Current Report on Form 8-K dated April 27, 2012 and filed with

the SEC on May 2, 2012).

4.14 Amendment and Joinder to Guarantee, dated as of September 30, 2012, by TWCE, TW NY and TWC

Internet Holdings II, in favor of Citibank, N.A., as Administrative Agent for the lenders, parties to the $3.5

billion five-year credit agreement, dated as of April 27, 2012, by and among, the Company, the lenders party

thereto, Citibank, N.A., as Administrative Agent, BNP Paribas, Deutsche Bank Securities Inc. and Wells

Fargo Bank, National Association, as Co-Syndication Agents, and Barclays Bank PLC, JPMorgan Chase

Bank, N.A., Mizuho Corporate Bank, LTD., RBC Capital Markets, Sumitomo Mitsui Banking Corporation,

The Bank of Tokyo-Mitsubishi UFJ, LTD. and The Royal Bank of Scotland plc, as Co-Documentation

Agents (incorporated herein by reference to Exhibit 4.3 to the TWC September 30, 2012 Form 8-K).

133