Time Warner Cable 2014 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

MARKET RISK MANAGEMENT

Market risk is the potential gain/loss arising from changes in market rates and prices, such as interest rates.

Interest Rate Risk

Fixed-rate Debt

As of December 31, 2014, TWC had fixed-rate debt with an outstanding balance of $23.052 billion and an estimated

fair value of $27.842 billion. As discussed below, TWC has entered into interest rate swaps to effectively convert a

portion of its fixed-rate debt to variable-rate debt. Based on TWC’s fixed-rate debt obligations outstanding at

December 31, 2014, a 25 basis point increase or decrease in the level of interest rates would, respectively, decrease or

increase the fair value of the fixed-rate debt by approximately $608 million (excluding the impact of such rate changes on

the fair value of the interest rate swaps). Such potential increases or decreases are based on certain simplifying

assumptions, including a constant level of fixed-rate debt and an immediate, across-the-board increase or decrease in the

level of interest rates with no other subsequent changes for the remainder of the period.

Variable-rate Debt

As of December 31, 2014, TWC had an outstanding balance of variable-rate debt of $507 million. Based on TWC’s

variable-rate debt obligations outstanding as of December 31, 2014, each 25 basis point increase or decrease in the level

of interest rates would, respectively, increase or decrease TWC’s annual interest expense by approximately $1 million.

Such potential increases or decreases are based on certain simplifying assumptions, including a constant level of variable-

rate debt for all maturities and an immediate, across-the-board increase or decrease in the level of interest rates with no

other subsequent changes for the remainder of the period.

Additionally, as discussed below, TWC has entered into interest rate swaps to effectively convert a portion of its

fixed-rate debt to variable-rate debt.

Interest Rate Derivative Transactions

The Company is exposed to the market risk of changes in interest rates. To manage the volatility relating to these

exposures, the Company’s policy is to maintain a mix of fixed-rate and variable-rate debt by entering into various interest

rate derivative transactions to help achieve that mix. Using interest rate swaps, the Company agrees to exchange, at

specified intervals, the difference between fixed and variable interest amounts calculated by reference to an agreed-upon

notional principal amount.

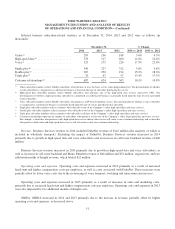

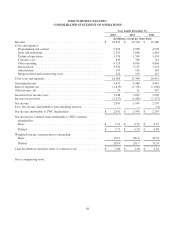

The following table summarizes the terms of the Company’s existing fixed to variable interest rate swaps as of

December 31, 2014:

Maturities .............................................................................. 2015-2019

Notional amount (in millions) .............................................................. $ 6,100

Weighted-average pay rate (variable based on LIBOR plus variable margins) ......................... 4.78%

Weighted-average receive rate (fixed) ........................................................ 6.58%

The notional amounts of interest rate instruments, as presented in the above table, are used to measure interest to be

paid or received and do not represent the amount of exposure to credit loss. Interest rate swaps represent an integral part of

the Company’s interest rate risk management program and resulted in a decrease in interest expense, net, of $116 million

in 2014.

61