Time Warner Cable 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

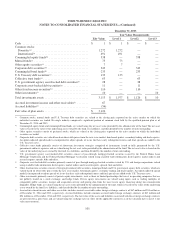

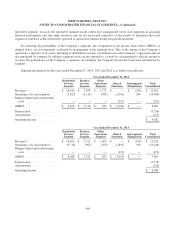

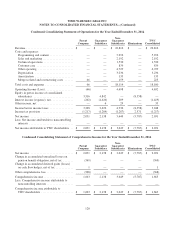

Revenue for the years ended December 31, 2014, 2013 and 2012 was derived from the following sources (in

millions):

Year Ended December 31,

2014 2013 2012

Residential Services revenue:

Video ..................................................... $ 10,002 $ 10,481 $ 10,917

High-speed data ............................................. 6,428 5,822 5,090

Voice ..................................................... 1,932 2,027 2,104

Other ..................................................... 84 72 64

Total Residential Services revenue ................................ 18,446 18,402 18,175

Business Services revenue:

Video ..................................................... 365 347 323

High-speed data ............................................. 1,341 1,099 912

Voice ..................................................... 511 421 306

Wholesale transport .......................................... 415 251 184

Other ..................................................... 206 194 176

Total Business Services revenue .................................. 2,838 2,312 1,901

Other Operations revenue:

Advertising ................................................ 1,127 1,019 1,053

Other ..................................................... 645 583 407

Total Other Operations revenue .................................. 1,772 1,602 1,460

Intersegment eliminations ....................................... (244) (196) (150)

Total revenue ................................................. $ 22,812 $ 22,120 $ 21,386

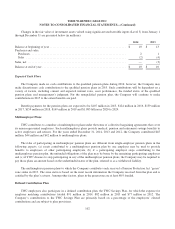

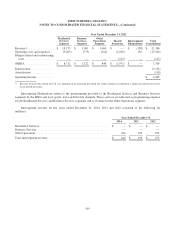

Use of OIBDA

Management uses Operating Income before Depreciation and Amortization (“OIBDA”), among other measures, in

evaluating the segment’s performance because it eliminates the effects of (i) considerable amounts of noncash

depreciation and amortization and (ii) items not within the control of the Company’s operations managers (such as income

tax provision, other income (expense), net, and interest expense, net). Management also uses this measure to evaluate the

Company’s consolidated operating performance and to allocate resources and capital to the segments. Performance

measures derived from OIBDA are also used in the Company’s annual incentive compensation programs. In addition, this

measure is commonly used by analysts, investors and others in evaluating the Company’s performance.

This measure has inherent limitations. For example, OIBDA does not reflect capital expenditures or the periodic

costs of certain capitalized assets used in generating revenue. To compensate for such limitations, management evaluates

the Company’s consolidated performance through, among other measures, various cash flow measures, which reflect

capital expenditure decisions, and net income attributable to TWC shareholders, which reflects the periodic costs of

capitalized assets. OIBDA also fails to reflect the significant costs borne by the Company for income taxes and debt

servicing costs, the results of the Company’s equity investments and other non-operational income or expense.

Management compensates for these limitations by using other analytics such as a review of net income attributable to

TWC shareholders.

This non-GAAP measure should be considered in addition to, not as a substitute for, the Company’s Operating

Income and net income attributable to TWC shareholders, as well as other measures of financial performance reported in

accordance with GAAP, and may not be comparable to similarly titled measures used by other companies.

110