Time Warner Cable 2014 Annual Report Download - page 87

Download and view the complete annual report

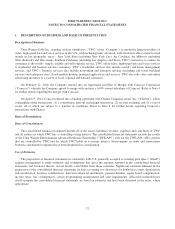

Please find page 87 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

TWC for the ability to distribute TWC’s services are recognized as revenue in the period in which TWC’s services are

distributed to a consumer. Fees received for managing certain functions for the Advance/Newhouse Partnership are

recognized as revenue ratably over the year, which approximates the period in which management functions are

performed. Home shopping network-related revenue is recognized as revenue in the period during which the merchandise

is sold or the carriage fees are earned.

In the normal course of business, the Company acts as or uses an intermediary or agent in executing transactions with

third parties. The accounting issue presented by these arrangements is whether revenue should be reported based on the

gross amount billed to the ultimate customer or on the net amount received from the customer after commissions and

other payments to third parties. To the extent revenue is recorded on a gross basis, any commissions or other payments to

third parties are recorded as expense so that the net amount (gross revenue less expense) is reflected in operating income.

Accordingly, the impact on operating income is the same whether the revenue was recorded on a gross or net basis.

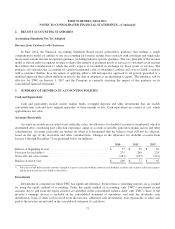

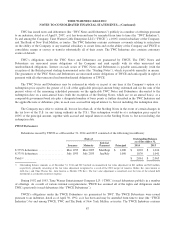

As an example, TWC is assessed franchise fees by franchising authorities, which are passed on to the customer. The

accounting issue presented by these arrangements is whether the revenue should be reported based on the gross amount

billed to the ultimate customer or on the net amount received from the customer after payments to franchising authorities.

In instances where the fees are being assessed directly to the Company, amounts paid to governmental authorities and

amounts received from customers are recorded on a gross basis. That is, amounts paid to governmental authorities are

recorded as operating costs and expenses and amounts received from customers are recorded as revenue. The amount of

such fees recorded on a gross basis related to video, high-speed data and voice services was $666 million in 2014, $685

million in 2013 and $695 million in 2012.

Operating Costs and Expenses

Programming, high-speed data connectivity and voice network costs are recorded as the services are provided.

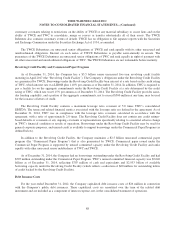

Programming costs are recorded based on the contractual agreements with programming vendors, which are generally

multi-year agreements under which payments are made to programming vendors at agreed upon rates based on the

number of subscribers to which programming services are provided. If a programming contract expires prior to the entry

into a new agreement and the service continues to be distributed, programming costs are estimated during contract

negotiations considering previous contractual rates, inflation and the status of the negotiations. When the programming

contract terms are finalized, an adjustment to programming expense is recorded, if necessary, to reflect the terms of the

new contract. Estimates are also made in the recognition of programming expense related to other items, such as the

accounting for free periods and credits from service interruptions, as well as the allocation of consideration exchanged

between the parties in multiple-element transactions. Additionally, judgments are also required when multiple services are

purchased from the same programming vendor. In these scenarios, the total consideration provided to the programming

vendor is allocated to the various services received based upon their respective estimated fair values. Because multiple

services from the same programming vendor may be received over different contractual periods and may have different

contractual rates, the allocation of consideration to the individual services may have an impact on the timing of expense

recognition. Accounting for consideration exchanged between the parties in multiple-element transactions is discussed

further in “—Multiple-element Transactions—Contemporaneous Purchases and Sales” below.

Launch fees received from programming vendors are recognized as a reduction of expense on a straight-line basis

over the term of the related programming arrangement. Amounts received from programming vendors representing the

reimbursement of marketing costs are recognized as a reduction of marketing expense as the marketing services are

provided.

Advertising costs are expensed upon the first exhibition of the related advertisements. Marketing expense (including

advertising), net of certain reimbursements from programmers, was $684 million in 2014, $676 million in 2013 and

$653 million in 2012.

79