Time Warner Cable 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

On April 25, 2014, Comcast entered into a binding agreement with Charter, which contemplates three transactions

(the “divestiture transactions”): (1) a contribution, spin-off and merger transaction, (2) an asset exchange and (3) a sale of

assets. The completion of the divestiture transactions will result in the combined company divesting a net total of

approximately 3.9 million video subscribers, a portion of which are TWC subscribers (primarily in the Midwest). The

divestiture transactions are expected to occur contemporaneously with one another and are conditioned upon and will

occur following the closing of the Comcast merger. They are also subject to a number of other conditions. The Comcast

merger is not conditioned upon the closing of the divestiture transactions and, accordingly, the Comcast merger can be

completed regardless of whether the divestiture transactions are ultimately completed.

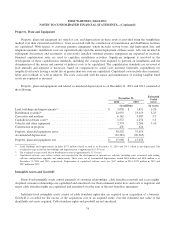

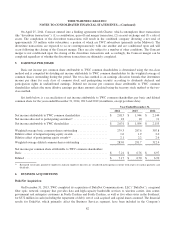

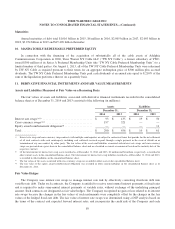

5. EARNINGS PER SHARE

Basic net income per common share attributable to TWC common shareholders is determined using the two-class

method and is computed by dividing net income attributable to TWC common shareholders by the weighted average of

common shares outstanding during the period. The two-class method is an earnings allocation formula that determines

income per share for each class of common stock and participating security according to dividends declared and

participation rights in undistributed earnings. Diluted net income per common share attributable to TWC common

shareholders reflects the more dilutive earnings per share amount calculated using the treasury stock method or the two-

class method.

Set forth below is a reconciliation of net income attributable to TWC common shareholders per basic and diluted

common share for the years ended December 31, 2014, 2013 and 2012 (in millions, except per share data):

Year Ended December 31,

2014 2013 2012

Net income attributable to TWC common shareholders .................. $ 2,013 $ 1,944 $ 2,144

Net income allocated to participating securities(a) ....................... 18 10 11

Net income attributable to TWC shareholders ......................... $ 2,031 $ 1,954 $ 2,155

Weighted-average basic common shares outstanding .................... 279.3 287.6 307.8

Dilutive effect of nonparticipating equity awards ....................... 1.6 1.9 2.0

Dilutive effect of participating equity awards(a) ........................ 2.1 2.2 2.6

Weighted-average diluted common shares outstanding .................. 283.0 291.7 312.4

Net income per common share attributable to TWC common shareholders:

Basic ......................................................... $ 7.21 $ 6.76 $ 6.97

Diluted ........................................................ $ 7.17 $ 6.70 $ 6.90

(a) Restricted stock units granted to employees and non-employee directors are considered participating securities with respect to regular quarterly cash

dividends.

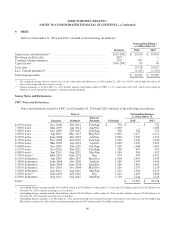

6. BUSINESS ACQUISITIONS

DukeNet Acquisition

On December 31, 2013, TWC completed its acquisition of DukeNet Communications, LLC (“DukeNet”), a regional

fiber optic network company that provides data and high-capacity bandwidth services to wireless carrier, data center,

government and enterprise customers in North Carolina and South Carolina, as well as five other states in the Southeast,

for $572 million in cash (including the repayment of debt), net of cash acquired and capital leases assumed. The financial

results for DukeNet, which primarily affect the Business Services segment, have been included in the Company’s

82