Time Warner Cable 2014 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

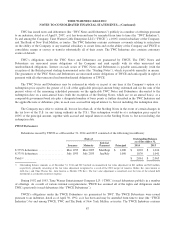

customary covenants relating to restrictions on the ability of TWCE or any material subsidiary to create liens and on the

ability of TWCE and TWC to consolidate, merge or convey or transfer substantially all of their assets. The TWCE

Indenture also contains customary events of default. TWCE has no obligation to file separate reports with the Securities

and Exchange Commission under the Securities Exchange Act of 1934, as amended.

The TWCE Debentures are unsecured senior obligations of TWCE and rank equally with its other unsecured and

unsubordinated obligations. Interest on each series of TWCE Debentures is payable semi-annually in arrears. The

guarantees of the TWCE Debentures are unsecured senior obligations of TWC and rank equally in right of payment with

all other unsecured and unsubordinated obligations of TWC. The TWCE Debentures are not redeemable before maturity.

Revolving Credit Facility and Commercial Paper Program

As of December 31, 2014, the Company has a $3.5 billion senior unsecured five-year revolving credit facility

maturing in April 2017 (the “Revolving Credit Facility”). The Company’s obligations under the Revolving Credit Facility

are guaranteed by TWCE. Borrowings under the Revolving Credit Facility bear interest at a rate based on the credit rating

of TWC, which interest rate was LIBOR plus 1.10% per annum as of December 31, 2014. In addition, TWC is required to

pay a facility fee on the aggregate commitments under the Revolving Credit Facility at a rate determined by the credit

rating of TWC, which rate was 0.15% per annum as of December 31, 2014. The Revolving Credit Facility provides same-

day funding capability, and a portion of the aggregate commitments, not to exceed $500 million at any time, may be used

for the issuance of letters of credit.

The Revolving Credit Facility contains a maximum leverage ratio covenant of 5.0 times TWC’s consolidated

EBITDA. The terms and related financial metrics associated with the leverage ratio are defined in the agreement. As of

December 31, 2014, TWC was in compliance with the leverage ratio covenant, calculated in accordance with the

agreement, with a ratio of approximately 2.8 times. The Revolving Credit Facility does not contain any credit ratings-

based defaults or covenants or any ongoing covenants or representations specifically relating to a material adverse change

in TWC’s financial condition or results of operations. Borrowings under the Revolving Credit Facility may be used for

general corporate purposes, and unused credit is available to support borrowings under the Commercial Paper Program (as

defined below).

In addition to the Revolving Credit Facility, the Company maintains a $2.5 billion unsecured commercial paper

program (the “Commercial Paper Program”) that is also guaranteed by TWCE. Commercial paper issued under the

Commercial Paper Program is supported by unused committed capacity under the Revolving Credit Facility and ranks

equally with other unsecured senior indebtedness of TWC and TWCE.

As of December 31, 2014, the Company had no borrowings outstanding under the Revolving Credit Facility and had

$507 million outstanding under the Commercial Paper Program. TWC’s unused committed financial capacity was $3.640

billion as of December 31, 2014, reflecting $707 million of cash and equivalents and $2.933 billion of available

borrowing capacity under the Revolving Credit Facility (which reflects a reduction of $60 million for outstanding letters

of credit backed by the Revolving Credit Facility).

Debt Issuance Costs

For the year ended December 31, 2012, the Company capitalized debt issuance costs of $26 million in connection

with the Company’s public debt issuances. These capitalized costs are amortized over the term of the related debt

instrument and are included as a component of interest expense, net, in the consolidated statement of operations.

88