Time Warner Cable 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

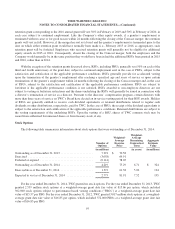

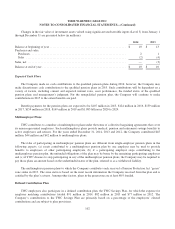

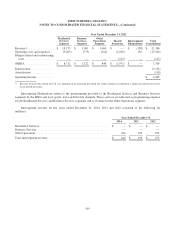

The differences between income tax (benefit) provision expected at the U.S. federal statutory income tax rate of 35%

and income tax (benefit) provision provided for the years ended December 31, 2014, 2013 and 2012 consisted of the

following (in millions):

Year Ended December 31,

2014 2013 2012

Income tax provision at U.S. federal statutory rate ..................... $ 1,137 $ 1,064 $ 1,168

State and local taxes, net of federal tax effects ........................ 112 28 31

Other ......................................................... (32) (7) (22)

Total ......................................................... $ 1,217 $ 1,085 $ 1,177

The income tax provision and effective tax rate for the year ended December 31, 2014 include a benefit of $24

million as a result of the passage of the New York State budget during the first quarter of 2014 that, in part, lowers the

New York State business tax rate beginning in 2016.

The income tax provision and effective tax rate for the year ended December 31, 2013 include (i) a benefit of $77

million primarily related to changes in the tax rate applied to calculate the Company’s net deferred income tax liability as

a result of changes to state tax apportionment factors and (ii) a benefit of $27 million resulting from income tax reform

legislation enacted in North Carolina, which, along with other changes, phases in a reduction in North Carolina’s

corporate income tax rate over several years.

The income tax provision and effective tax rate for the year ended December 31, 2012 include (i) a benefit of $63

million related to a change in the tax rate applied to calculate the Company’s net deferred income tax liability as a result

of an internal reorganization effective on September 30, 2012, (ii) a benefit of $47 million primarily related to a California

state tax law change, (iii) a benefit of $46 million related to the reversal of a valuation allowance against a deferred

income tax asset associated with the Company’s investment in Clearwire and (iv) a charge of $15 million related to the

recording of a deferred income tax liability associated with a partnership basis difference.

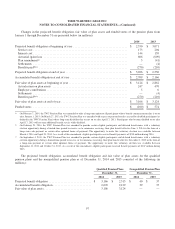

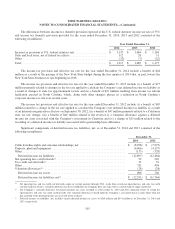

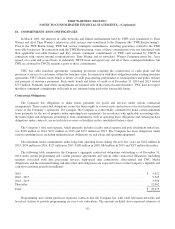

Significant components of deferred income tax liabilities, net, as of December 31, 2014 and 2013 consisted of the

following (in millions):

December 31,

2014 2013

Cable franchise rights and customer relationships, net ............................... $ (8,298) $ (7,979)

Property, plant and equipment .................................................. (4,466) (4,157)

Other ...................................................................... (133) (328)

Deferred income tax liabilities ................................................ (12,897) (12,464)

Net operating loss carryforwards(a) .............................................. 92 202

Tax credit carryforwards(a) ..................................................... 31 32

Other ...................................................................... 511 494

Valuation allowances(b) ....................................................... (28) (28)

Deferred income tax assets ................................................... 606 700

Deferred income tax liabilities, net(c) ........................................... $ (12,291) $ (11,764)

(a) Net operating loss and tax credit carryforwards expire in varying amounts through 2034. Aside from certain net operating loss and state tax credit

carryforwards for which a valuation allowance has been established, the Company does not expect these carryforwards to expire unutilized.

(b) The Company’s valuation allowance for deferred income tax assets recorded as of December 31, 2014 and 2013, primarily relates to certain net

operating loss and state tax credit carryforwards. The valuation allowance is based upon the Company’s assessment that it is more likely than not

that a portion of the deferred income tax asset will not be realized.

(c) Deferred income tax liabilities, net, includes current deferred income tax assets of $269 million and $334 million as of December 31, 2014 and

2013, respectively.

105