Time Warner Cable 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

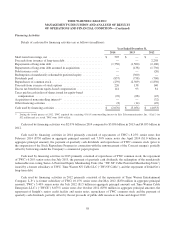

period. The Company recognized pension expense associated with these plans of $81 million, $205 million and $183

million in 2014, 2013 and 2012, respectively. Pension expense is determined using certain assumptions, including the

expected long-term rate of return on plan assets, discount rate and expected rate of compensation increases. TWC uses a

December 31 measurement date for its pension plans. See Notes 3 and 14 to the accompanying consolidated financial

statements for additional discussion. The determination of these assumptions is discussed in more detail below.

The Company used a discount rate of 5.27% to compute 2014 pension expense, which was determined by the

matching of plan liability cash flows to a portfolio of bonds individually selected from a large population of high-quality

corporate bonds. A decrease in the discount rate of 25 basis points, from 5.27% to 5.02% while holding all other

assumptions constant, would have resulted in an increase in the Company’s pension expense of approximately $15 million

in 2014.

The Company’s expected long-term rate of return on plan assets used to compute 2014 pension expense was 7.50%.

In developing the expected long-term rate of return on assets, the Company considered the pension portfolio’s

composition, past average rate of earnings, discussions with portfolio managers and the Company’s asset allocation

targets. A decrease in the expected long-term rate of return of 25 basis points, from 7.50% to 7.25%, while holding all

other assumptions constant, would have resulted in an increase in the Company’s pension expense of approximately $8

million in 2014.

The Company used an estimated rate of future compensation increases of 4.75% to compute 2014 pension expense.

A decrease in the rate of 25 basis points, from 4.75% to 4.50%, while holding all other assumptions constant, would have

resulted in a decrease in the Company’s pension expense of approximately $6 million in 2014.

Programming Agreements

The Company exercises significant judgment in estimating programming expense associated with certain video

programming contracts. The Company’s policy is to record programming costs based on the contractual agreements with

programming vendors, which are generally multi-year agreements under which payments are made to programming

vendors at agreed upon rates based on the number of subscribers to which programming services are provided. If a

programming contract expires prior to the entry into a new agreement and the service continues to be distributed,

programming costs are estimated during contract negotiations considering previous contractual rates, inflation and the

status of the negotiations. When the programming contract terms are finalized, an adjustment to programming expense is

recorded, if necessary, to reflect the terms of the new contract. Estimates are also made in the recognition of programming

expense related to other items, such as the accounting for free periods and credits from service interruptions, as well as the

allocation of consideration exchanged between the parties in multiple-element transactions. Additionally, judgments are

also required when multiple services are purchased from the same programming vendor. In these scenarios, the total

consideration provided to the programming vendor is allocated to the various services received based upon their

respective estimated fair values. Because multiple services from the same programming vendor may be received over

different contractual periods and may have different contractual rates, the allocation of consideration to the individual

services may have an impact on the timing of expense recognition.

Significant judgment is also involved when the Company enters into agreements that result in the Company receiving

cash consideration from the programming vendor, usually in the form of advertising sales, channel positioning fees,

launch support or marketing support. In these situations, management must determine based upon facts and circumstances

if such cash consideration should be recorded as revenue, a reduction in programming expense or a reduction in another

expense category (e.g., marketing).

64