Time Warner Cable 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

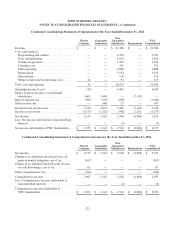

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

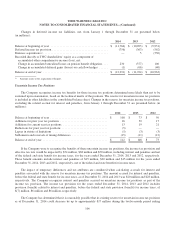

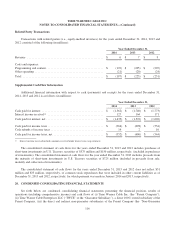

Related Party Transactions

Transactions with related parties (i.e., equity-method investees) for the years ended December 31, 2014, 2013 and

2012 consisted of the following (in millions):

Year Ended December 31,

2014 2013 2012

Revenue .................................................... $ 6 $ 7 $ 9

Costs and expenses:

Programming and content ....................................... $ (176) $ (205) $ (207)

Other operating ............................................... (21) (20) (24)

Total ....................................................... $ (197) $ (225) $ (231)

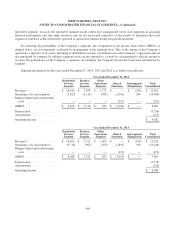

Supplemental Cash Flow Information

Additional financial information with respect to cash (payments) and receipts for the years ended December 31,

2014, 2013 and 2012 is as follows (in millions):

Year Ended December 31,

2014 2013 2012

Cash paid for interest .......................................... $ (1,562) $ (1,740) $ (1,773)

Interest income received(a) ...................................... 127 164 171

Cash paid for interest, net ....................................... $ (1,435) $ (1,576) $ (1,602)

Cash paid for income taxes ...................................... $ (366) $ (698) $ (554)

Cash refunds of income taxes .................................... 14 2 10

Cash paid for income taxes, net .................................. $ (352) $ (696) $ (544)

(a) Interest income received includes amounts received under interest rate swap contracts.

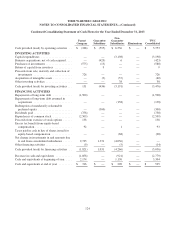

The consolidated statement of cash flows for the years ended December 31, 2013 and 2012 includes purchases of

short-term investments in U.S. Treasury securities of $575 million and $150 million, respectively, (included in purchases

of investments). The consolidated statement of cash flows for the year ended December 31, 2013 includes proceeds from

the maturity of short-term investments in U.S. Treasury securities of $725 million (included in proceeds from sale,

maturity and collection of investments).

The consolidated statement of cash flows for the years ended December 31, 2013 and 2012 does not reflect $51

million and $33 million, respectively, of common stock repurchases that were included in other current liabilities as of

December 31, 2013 and 2012, respectively, for which payment was made in January 2014 and 2013, respectively.

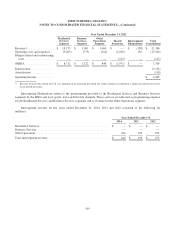

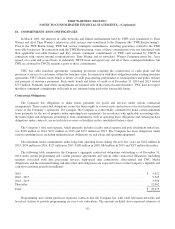

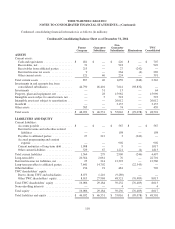

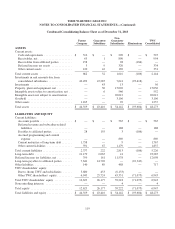

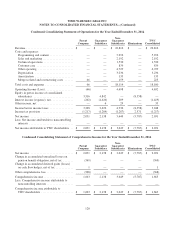

20. CONDENSED CONSOLIDATING FINANCIAL STATEMENTS

Set forth below are condensed consolidating financial statements presenting the financial position, results of

operations (including comprehensive income) and cash flows of (i) Time Warner Cable Inc. (the “Parent Company”),

(ii) Time Warner Cable Enterprises LLC (“TWCE” or the “Guarantor Subsidiary”), a direct 100% owned subsidiary of the

Parent Company, (iii) the direct and indirect non-guarantor subsidiaries of the Parent Company (the “Non-Guarantor

116