Time Warner Cable 2014 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

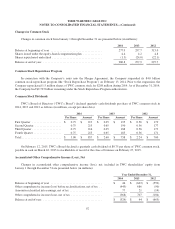

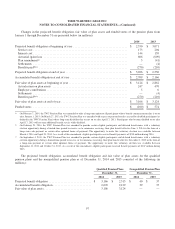

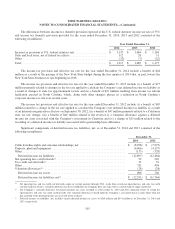

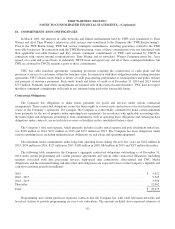

Changes in the fair value of investment assets valued using significant unobservable inputs (Level 3) from January 1

through December 31 are presented below (in millions):

2014 2013

Balance at beginning of year .................................................... $ 10 $ 13

Purchases and sales:

Purchases ................................................................. 2 1

Sales .................................................................... (2) (4)

Sales, net ................................................................... — (3)

Balance at end of year ......................................................... $ 10 $ 10

Expected Cash Flows

The Company made no cash contributions to the qualified pension plans during 2014; however, the Company may

make discretionary cash contributions to the qualified pension plans in 2015. Such contributions will be dependent on a

variety of factors, including current and expected interest rates, asset performance, the funded status of the qualified

pension plans and management’s judgment. For the nonqualified pension plan, the Company will continue to make

contributions in 2015 to the extent benefits are paid.

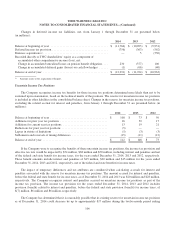

Benefit payments for the pension plans are expected to be $107 million in 2015, $124 million in 2016, $139 million

in 2017, $154 million in 2018, $169 million in 2019 and $1.085 billion in 2020 to 2024.

Multiemployer Plans

TWC contributes to a number of multiemployer plans under the terms of collective-bargaining agreements that cover

its union-represented employees. Such multiemployer plans provide medical, pension and retirement savings benefits to

active employees and retirees. For the years ended December 31, 2014, 2013 and 2012, the Company contributed $45

million, $44 million and $42 million to multiemployer plans.

The risks of participating in multiemployer pension plans are different from single-employer pension plans in the

following aspects: (a) assets contributed to a multiemployer pension plan by one employer may be used to provide

benefits to employees of other participating employers, (b) if a participating employer stops contributing to the

multiemployer pension plan, the unfunded obligations of the plan may be borne by the remaining participating employers

and (c) if TWC chooses to stop participating in any of the multiemployer pension plans, the Company may be required to

pay those plans an amount based on the underfunded status of the plan, referred to as a withdrawal liability.

The multiemployer pension plans to which the Company contributes each received a Pension Protection Act “green”

zone status in 2013. The zone status is based on the most recent information the Company received from the plan and is

certified by the plan’s actuary. Among other factors, plans in the green zone are at least 80% funded.

Defined Contribution Plan

TWC employees also participate in a defined contribution plan, the TWC Savings Plan, for which the expense for

employer matching contributions totaled $91 million in 2014, $82 million in 2013 and $77 million in 2012. The

Company’s contributions to the TWC Savings Plan are primarily based on a percentage of the employees’ elected

contributions and are subject to plan provisions.

102