Time Warner Cable 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

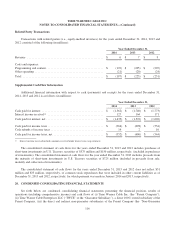

18. COMMITMENTS AND CONTINGENCIES

In March 2003, the interests in cable networks and filmed entertainment held by TWE were transferred to Time

Warner and all of Time Warner’s interests in cable systems were transferred to the Company (the “TWE Restructuring”).

Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to the TWE

non-cable businesses. In connection with the TWE Restructuring, some of these commitments were not transferred with

their applicable non-cable business and they remain contingent commitments of TWE (and assumed by TWCE in

connection with various internal reorganizations). Time Warner and its subsidiary, Warner Communications Inc., have

agreed, on a joint and several basis, to indemnify TWCE from and against any and all of these contingent liabilities, but

TWE (as assumed by TWCE) remains a party to these commitments.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing franchise

agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and public utilities

and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2014 and 2013 totaled

$373 million. Payments under these arrangements are required only in the event of nonperformance. TWC does not expect

that these contingent commitments will result in any amounts being paid in the foreseeable future.

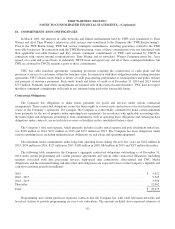

Contractual Obligations

The Company has obligations to make future payments for goods and services under certain contractual

arrangements. These contractual obligations secure the future rights to various assets and services to be used in the normal

course of the Company’s operations. For example, the Company is contractually committed to make certain minimum

lease payments for the use of property under operating lease agreements. In accordance with applicable accounting rules,

the future rights and obligations pertaining to firm commitments, such as operating lease obligations and certain purchase

obligations under contracts, are not reflected as assets or liabilities in the consolidated balance sheet.

The Company’s total rent expense, which primarily includes facility rental expense and pole attachment rental fees,

was $298 million in 2014, $257 million in 2013 and $237 million in 2012. The Company has lease obligations under

various operating leases including minimum lease obligations for real estate and operating equipment.

The minimum rental commitments under long-term operating leases during the next five years are $162 million in

2015, $156 million in 2016, $127 million in 2017, $108 million in 2018, $84 million in 2019 and $293 million thereafter.

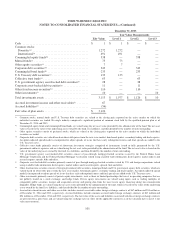

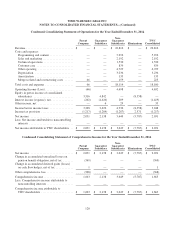

The following table summarizes the Company’s aggregate contractual obligations outstanding as of December 31,

2014 under certain programming and content purchase agreements and various other contractual obligations (including

amounts associated with data processing services, high-speed data connectivity, fiber-related and TWC Media

obligations) and the estimated timing and effect that such obligations are expected to have on the Company’s liquidity and

cash flows in future periods (in millions):

2015 ................................................................................... $ 5,612

2016 - 2017 ............................................................................. 9,305

2018 - 2019 ............................................................................. 5,994

Thereafter ............................................................................... 12,062

Total ................................................................................... $ 32,973

Programming and content purchases represent contracts that the Company has with cable television networks and

broadcast stations to provide programming services to its subscribers. The amounts included above represent estimates of

111