Time Warner Cable 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

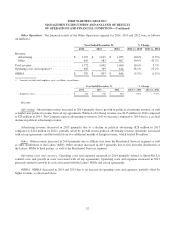

connection with the DukeNet acquisition. During 2013, the Company incurred merger-related costs of $13 million in

connection with the Insight and DukeNet acquisitions. During 2012, the Company incurred merger-related costs of $54

million, primarily associated with the Insight acquisition. The Company expects to incur additional merger-related costs in

2015.

The Company incurred restructuring costs of $27 million during 2014 compared to $106 million in 2013 and $61

million in 2012. These restructuring costs were primarily related to employee terminations and other exit costs. The

Company expects to incur additional restructuring costs in 2015.

Operating Income. Operating Income increased in 2014 primarily due to growth in revenue, partially offset by

higher operating costs and expenses, merger-related and restructuring costs and depreciation, as discussed above.

Operating Income increased in 2013 primarily due to growth in revenue, partially offset by increases in operating costs

and expenses and amortization, as discussed above.

Interest expense, net. Interest expense, net, decreased in 2014 and 2013 primarily due to lower average fixed-rate

debt outstanding during the periods as compared to the prior year.

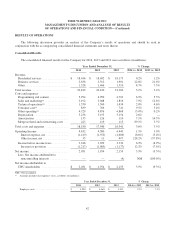

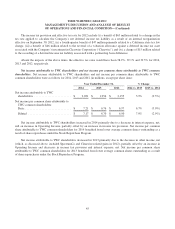

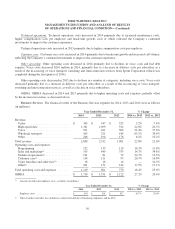

Other income, net. Other income, net, detail is shown in the table below (in millions):

Year Ended December 31,

2014 2013 2012

Income from equity-method investments, net(a) ............................ $ 33 $ 19 $ 454

Gain (loss) on equity award reimbursement obligation to Time Warner(b) ........ 1 (10) (9)

Gain on sale of investment in Clearwire Corporation ........................ — — 64

Other investment losses(c) ............................................. — — (12)

Other ............................................................. 1 2 —

Other income, net ................................................... $ 35 $ 11 $ 497

(a) Income from equity-method investments, net, in 2012 primarily consists of a pretax gain of $430 million associated with SpectrumCo, LLC’s

(“SpectrumCo”) sale of its advanced wireless spectrum licenses to Cellco Partnership (doing business as Verizon Wireless). SpectrumCo was a joint

venture between TWC, Comcast and Bright House Networks, LLC.

(b) See Note 11 to the accompanying consolidated financial statements for a discussion of the Company’s accounting for its equity award

reimbursement obligation to Time Warner Inc. (“Time Warner”).

(c) Other investment losses in 2012 represents an impairment of the Company’s investment in Canoe Ventures LLC, an equity-method investee.

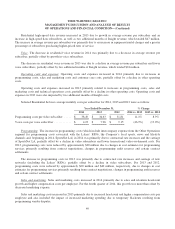

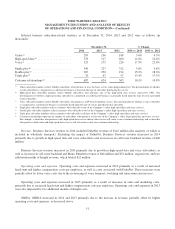

Income tax provision. In 2014, 2013 and 2012, the Company recorded income tax provisions of $1.217 billion,

$1.085 billion and $1.177 billion, respectively. As discussed above, income before income taxes in 2012 included the

SpectrumCo-related gain, which impacted the 2012 income tax provision. The effective tax rates were 37.5%, 35.7% and

35.3% for 2014, 2013 and 2012, respectively.

The income tax provision and effective tax rate for 2014 include a benefit of $24 million as a result of the passage of

the New York State budget during the first quarter of 2014 that, in part, lowers the New York State business tax rate

beginning in 2016.

The income tax provision and effective tax rate for 2013 include (i) a benefit of $77 million (of which $45 million

was recorded in the fourth quarter of 2013) primarily related to changes in the tax rate applied to calculate the Company’s

net deferred income tax liability as a result of changes to state tax apportionment factors and (ii) a benefit of $27 million

resulting from income tax reform legislation enacted in North Carolina, which, along with other changes, phases in a

reduction in North Carolina’s corporate income tax rate over several years.

44