Time Warner Cable 2014 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

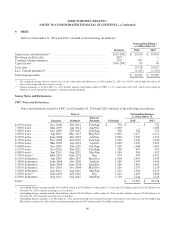

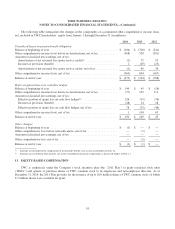

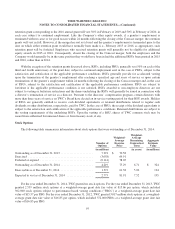

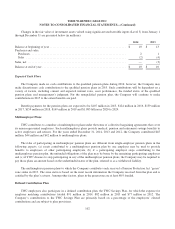

Equity-based compensation expense and the related income tax benefit recognized for the years ended December 31,

2014, 2013 and 2012 was as follows (in millions):

Year Ended December 31,

2014 2013 2012

Equity-based compensation expense recognized:

Restricted stock units(a) ............................................. $ 160 $ 89 $ 85

Stock options .................................................... 22 39 45

Total equity-based compensation expense(a) ............................ $ 182 $ 128 $ 130

Income tax benefit recognized ....................................... $ 71 $ 49 $ 51

(a) Amounts in 2014 include $56 million of equity-based compensation expense recognized in merger-related and restructuring costs in the

consolidated statement of operations.

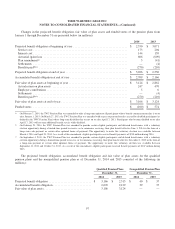

Restricted Stock Units

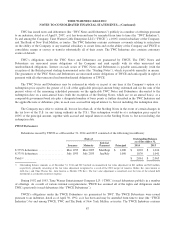

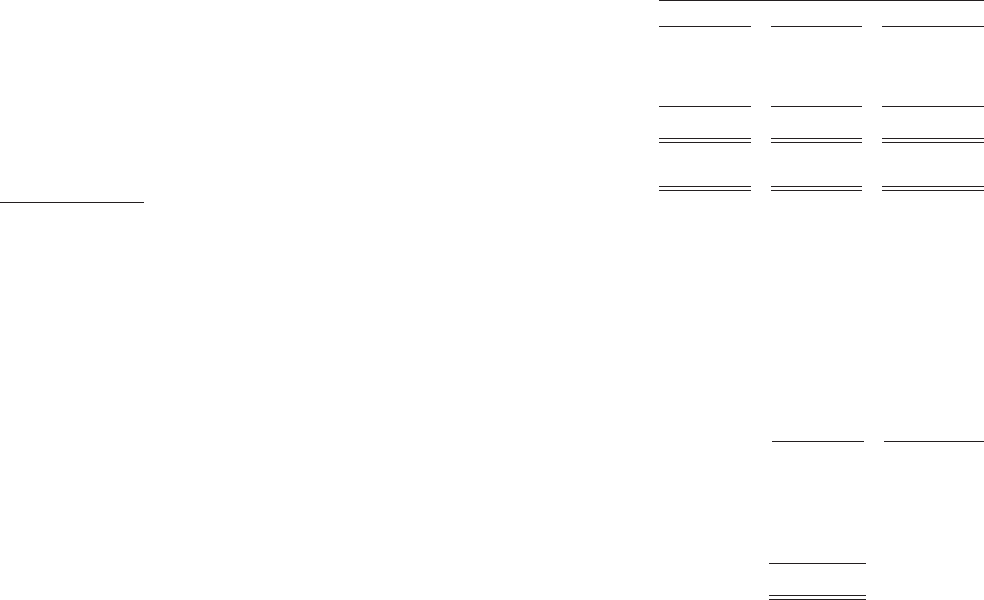

The following table summarizes information about unvested RSUs for the year ended December 31, 2014:

Number of

Units

Weighted-

Average

Grant Date

Value

(in millions)

Unvested as of December 31, 2013 ..................................... 4.086 $ 72.42

Granted ........................................................... 3.807 135.81

Vested ........................................................... (1.416) 61.65

Forfeited .......................................................... (0.213) 111.16

Unvested as of December 31, 2014 ..................................... 6.264 112.06

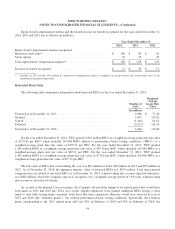

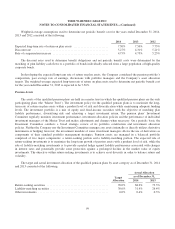

For the year ended December 31, 2014, TWC granted 3.807 million RSUs at a weighted-average grant date fair value

of $135.81 per RSU, which included 143,000 RSUs subject to performance-based vesting conditions (“PBUs”) at a

weighted-average grant date fair value of $135.31 per PBU. For the year ended December 31, 2013, TWC granted

1.200 million RSUs at a weighted-average grant date fair value of $87.30 per RSU, which included 142,000 PBUs at a

weighted-average grant date fair value of $87.31 per PBU. For the year ended December 31, 2012, TWC granted

1.442 million RSUs at a weighted-average grant date fair value of $77.09 per RSU, which included 196,000 PBUs at a

weighted-average grant date fair value of $77.13 per PBU.

The fair value of RSUs that vested during the year was $87 million in 2014, $98 million in 2013 and $95 million in

2012. As of December 31, 2014, the aggregate intrinsic value of unvested RSUs was $953 million. Total unrecognized

compensation cost related to unvested RSUs as of December 31, 2014, without taking into account expected forfeitures,

was $462 million, which the Company expects to recognize over a weighted-average period of 3.69 years, without taking

into account acceleration of vesting.

As a result of the planned Comcast merger, the Company advanced the timing of its annual grants that would have

been made in 2015 and 2016 into 2014. As a result, eligible employees were granted additional RSUs having a value

equal to (and with vesting terms consistent with) those that these employees otherwise would have received in each of

2015 and 2016 (the “retention grants”), but without performance-based vesting conditions. Specifically, the retention

grant corresponding to the 2015 annual grant will vest 50% in February of 2018 and 50% in February of 2019; the

94