Time Warner Cable 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

Indefinite-lived Intangible Assets and Goodwill

At least annually, separate tests are performed to determine if the Company’s indefinite-lived intangible assets

(primarily cable franchise rights) and goodwill are impaired. Under the accounting rules, a qualitative assessment may be

performed to determine if an impairment is more likely than not to have occurred. If an impairment is more likely than not

to have occurred, then a quantitative assessment is required, which may or may not result in an impairment charge. The

determination of whether an impairment is more likely than not to have occurred requires significant judgment regarding

potential changes in valuation inputs and includes a review of the Company’s most recent projections, analysis of

operating results versus the prior year and budget, changes in market values, changes in discount rates and changes in

terminal growth rate assumptions. As discussed further in Note 8 to the accompanying consolidated financial statements,

as of the Company’s July 1, 2014 annual testing date and based on its qualitative assessment, the Company determined

that it was not more likely than not that its cable franchise rights and goodwill were impaired and, therefore, the Company

did not perform a quantitative assessment as part of its annual impairment testing.

Income Taxes

From time to time, transactions occur in which the tax consequences may be subject to uncertainty. Significant

judgment is required in assessing and estimating the tax consequences of these transactions. Income tax returns are

prepared and filed based on interpretation of tax laws and regulations. In the normal course of business, income tax

returns are subject to examination by various taxing authorities. Such examinations may result in future tax, interest and

penalty assessments by these taxing authorities. In determining the income tax provision for financial reporting purposes,

a reserve for uncertain income tax positions is established unless it is determined that such positions are more likely than

not to be sustained upon examination, based on their technical merits. There is considerable judgment involved in

determining whether positions taken on the income tax return are more likely than not to be sustained.

Income tax reserve estimates are adjusted periodically because of ongoing examinations by, and settlements with, the

various taxing authorities, as well as changes in tax laws, regulations and interpretations. The consolidated income tax

provision for any given year includes adjustments to prior year income tax accruals that are considered appropriate and

any related estimated interest. When applicable, interest and penalties are recognized on uncertain income tax positions as

part of the income tax provision. Refer to Note 16 to the accompanying consolidated financial statements for further

details.

Legal Contingencies

The Company is subject to legal, regulatory and other proceedings and claims that arise in the ordinary course of

business. An estimated liability is recorded for those proceedings and claims arising in the ordinary course of business

when the loss from such proceedings and claims becomes probable and reasonably estimable. Outstanding claims are

reviewed with internal and external counsel to assess the probability and the estimates of loss, including the possible range

of an estimated loss. The risk of loss is reassessed as new information becomes available and liabilities are adjusted as

appropriate. The actual cost of resolving a claim may be substantially different from the amount of the liability recorded.

Differences between the estimated and actual amounts determined upon ultimate resolution, individually or in the

aggregate, are not expected to have a material adverse effect on the consolidated financial position but could possibly be

material to the consolidated results of operations or cash flows for any one period.

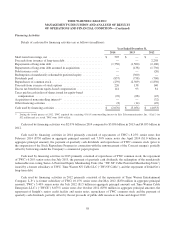

Pension Plans

TWC sponsors two qualified defined benefit pension plans that provide pension benefits to a majority of the

Company’s employees. TWC also provides a nonqualified defined benefit pension plan for certain employees. Pension

benefits are based on formulas that reflect the employees’ years of service and compensation during their employment

63