Time Warner Cable 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

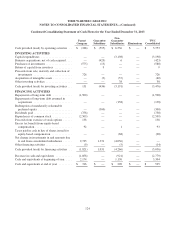

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

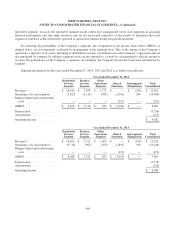

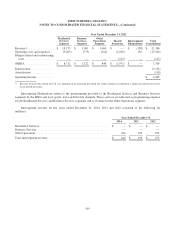

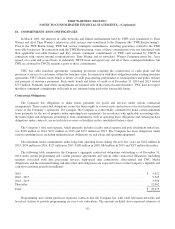

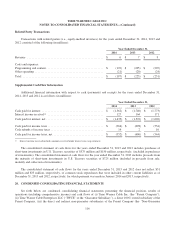

Condensed consolidating financial information is as follows (in millions):

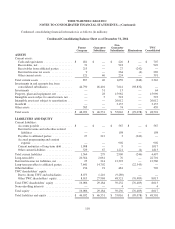

Condensed Consolidating Balance Sheet as of December 31, 2014

Parent

Company

Guarantor

Subsidiary

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

ASSETS

Current assets:

Cash and equivalents ................... $ 481 $ — $ 226 $ — $ 707

Receivables, net ....................... 31 — 918 — 949

Receivables from affiliated parties ........ 215 — 27 (242) —

Deferred income tax assets .............. 9 — 264 (4) 269

Other current assets .................... 121 46 224 — 391

Total current assets ...................... 857 46 1,659 (246) 2,316

Investments in and amounts due from

consolidated subsidiaries ................ 44,790 46,401 7,641 (98,832) —

Investments ............................ — 51 13 — 64

Property, plant and equipment, net .......... — 28 15,962 — 15,990

Intangible assets subject to amortization, net . . — 5 518 — 523

Intangible assets not subject to amortization . . . — — 26,012 — 26,012

Goodwill .............................. — — 3,137 — 3,137

Other assets ............................ 385 — 74 — 459

Total assets ............................ $ 46,032 $ 46,531 $ 55,016 $ (99,078) $ 48,501

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable ...................... $ — $ — $ 567 $ — $ 567

Deferred revenue and subscriber-related

liabilities .......................... — — 198 — 198

Payables to affiliated parties ............. 27 212 3 (242) —

Accrued programming and content

expense ........................... — — 902 — 902

Current maturities of long-term debt ....... 1,008 — 9 — 1,017

Other current liabilities ................. 529 67 1,221 (4) 1,813

Total current liabilities .................... 1,564 279 2,900 (246) 4,497

Long-term debt ......................... 20,564 2,061 76 — 22,701

Deferred income tax liabilities, net .......... 23 214 12,323 — 12,560

Long-term payables to affiliated parties ...... 7,641 14,702 — (22,343) —

Other liabilities ......................... 154 91 481 — 726

TWC shareholders’ equity:

Due to (from) TWC and subsidiaries ...... 8,073 1,216 (9,289) — —

Other TWC shareholders’ equity .......... 8,013 27,968 48,521 (76,489) 8,013

Total TWC shareholders’ equity ............ 16,086 29,184 39,232 (76,489) 8,013

Noncontrolling interests .................. — — 4 — 4

Total equity ............................ 16,086 29,184 39,236 (76,489) 8,017

Total liabilities and equity ................. $ 46,032 $ 46,531 $ 55,016 $ (99,078) $ 48,501

118