Time Warner Cable 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

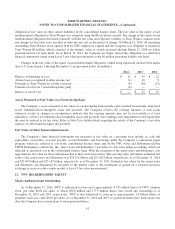

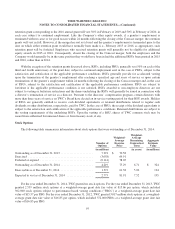

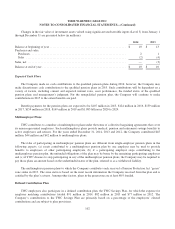

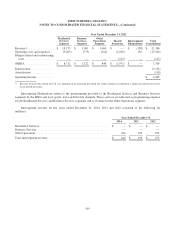

The following tables set forth the investment assets of the qualified pension plans, which exclude accrued investment

income and other receivables and accrued liabilities, by level within the fair value hierarchy as of December 31, 2014 and

2013 (in millions):

December 31, 2014

Fair Value Measurements

Fair Value Level 1 Level 2 Level 3

Common stocks:

Domestic(a) ...................................... $ 1,176 $ 1,176 $ — $ —

International(a) .................................... 412 412 — —

Commingled equity funds(b) ........................... 348 — 348 —

Mutual funds(a) ..................................... 70 70 — —

Other equity securities(c) .............................. 3 3 — —

Corporate debt securities(d) ............................ 361 — 361 —

Commingled bond funds(b) ............................ 268 — 268 —

U.S. Treasury debt securities(a) ......................... 194 194 — —

Collective trust funds(e) ............................... 80 — 80 —

U.S. government agency asset-backed debt securities(f) ..... 34 — 34 —

Corporate asset-backed debt securities(g) ................. 10 — 10 —

Other fixed-income securities(h) ........................ 130 — 130 —

Other investments(i) ................................. 14 4 — 10

Total investments assets .............................. 3,100 $ 1,859 $ 1,231 $ 10

Accrued investment income and other receivables(j) ........ 79

Accrued liabilities(j) ................................. (73)

Fair value of plan assets .............................. $ 3,106

100