Time Warner Cable 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

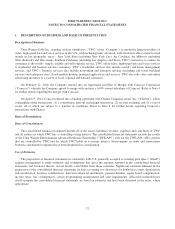

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

• Level 2: consists of financial instruments whose values are determined using models or other valuation

methodologies that utilize inputs that are observable either directly or indirectly, including (i) quoted prices for

similar assets or liabilities in active markets, (ii) quoted prices for identical or similar assets or liabilities in

markets that are not active, (iii) pricing models whose inputs are observable for substantially the full term of the

financial instrument and (iv) pricing models whose inputs are derived principally from or corroborated by

observable market data through correlation or other means for substantially the full term of the financial

instrument.

• Level 3: consists of financial instruments whose values are determined using pricing models that utilize

significant inputs that are primarily unobservable, DCF methodologies, or similar techniques, as well as

instruments for which the determination of fair value requires significant management judgment or estimation.

Pension Plans

TWC sponsors the TWC Pension Plan (as defined in Note 14) and the Union Pension Plan (as defined in Note 14),

both qualified defined benefit pension plans, that together provide pension benefits to a majority of the Company’s

employees. TWC also provides a nonqualified defined benefit pension plan for certain employees. Pension benefits are

based on formulas that reflect the employees’ years of service and compensation during their employment period. Pension

expense is determined using certain assumptions, including the expected long-term rate of return on plan assets, discount

rate and expected rate of compensation increases.

Equity-based Compensation

The cost of employee services received in exchange for an award of equity instruments is measured based on the

grant date fair value of the award. The cost of awards not subject to performance-based vesting conditions is recognized

on a straight-line basis over the requisite service period and, for awards subject to performance-based vesting conditions

deemed probable of being met, the cost is recognized over the requisite service period for each separately vesting tranche

of awards. The Black-Scholes model is used to estimate the grant date fair value of a stock option. Because the option-

pricing model requires the use of subjective assumptions, changes in these assumptions can materially affect the fair value

of stock options granted. The volatility assumption is calculated using the implied volatility of TWC traded options. The

expected term, which represents the period of time that options are expected to be outstanding, is estimated based on the

historical exercise experience of TWC employees. The risk-free rate assumed in valuing the stock options is based on the

U.S. Treasury yield curve in effect at the time of grant for the expected term of the option. The expected dividend yield

percentage is determined by dividing the expected annual dividend by the market price of TWC common stock at the date

of grant.

Segments

Public companies are required to disclose certain information about their reportable operating segments. Operating

segments are defined as significant components of an enterprise for which separate financial information is available and

is evaluated on a regular basis by the chief operating decision makers in deciding how to allocate resources to an

individual operating segment and in assessing performance of the operating segment. The Company classifies its

operations into three reportable segments: Residential Services, Business Services and Other Operations. Refer to Note 17

for further details.

Revenue and Costs

Revenue

Revenue consists of the revenue generated by each of the Company’s reportable segments: Residential Services,

Business Services and Other Operations.

77