Time Warner Cable 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

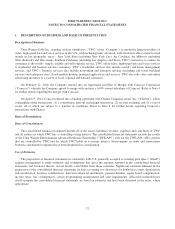

2. RECENT ACCOUNTING STANDARDS

Accounting Standards Not Yet Adopted

Revenue from Contracts with Customers

In May 2014, the Financial Accounting Standards Board issued authoritative guidance that outlines a single

comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes

most recent current revenue recognition guidance, including industry-specific guidance. The core principle of the revenue

model is that an entity recognizes revenue to depict the transfer of promised goods or services to customers in an amount

that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The

guidance also specifies the accounting for certain incremental costs of obtaining a contract and costs to fulfill a contract

with a customer. Entities have the option of applying either a full retrospective approach to all periods presented or a

modified approach that reflects differences prior to the date of adoption as an adjustment to equity. This guidance will be

effective for TWC on January 1, 2017 and the Company is currently assessing the impact of this guidance on its

consolidated financial statements.

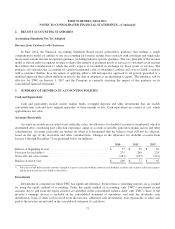

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily

convertible into cash and have original maturities of three months or less. Cash equivalents are carried at cost, which

approximates fair value.

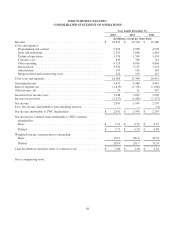

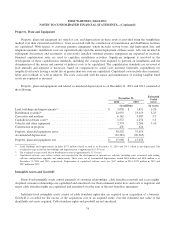

Accounts Receivable

Accounts receivable are recorded at net realizable value. An allowance for doubtful accounts is maintained, which is

determined after considering past collection experience, aging of accounts receivable, general economic factors and other

considerations. Accounts receivable are written off when it is determined that the balance owed will not be collected,

based on the age of the receivable and other considerations. Changes in the allowance for doubtful accounts from

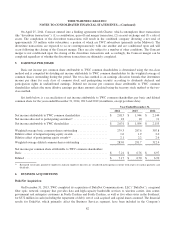

January 1 through December 31 are presented below (in millions):

2014 2013 2012

Balance at beginning of year ....................................... $ 77 $ 65 $ 62

Provision for bad debts(a) .......................................... 275 249 224

Write-offs, net of recoveries ....................................... (243) (237) (221)

Balance at end of year ............................................ $ 109 $ 77 $ 65

(a) Provision for bad debts includes amounts charged to expense associated with the allowance for doubtful accounts and excludes collection expenses

and the benefit from late fees billed to subscribers.

Investments

Investments in companies in which TWC has significant influence, but less than a controlling interest, are accounted

for using the equity method of accounting. Under the equity method of accounting, only TWC’s investment in and

amounts due to and from the equity investee are included in the consolidated balance sheet; only TWC’s share of the

investee’s earnings (losses) is included in the consolidated statement of operations; and only the dividends, cash

distributions, loans or other cash received from the investee, additional cash investments, loan repayments or other cash

paid to the investee are included in the consolidated statement of cash flows.

73