Time Warner Cable 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

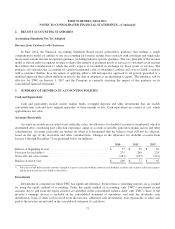

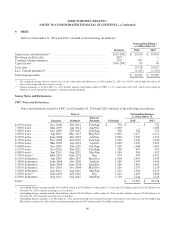

Income Taxes

Income taxes are provided using the asset and liability method.Under this method, income taxes (i.e., deferred

income tax assets, deferred income tax liabilities, taxes currently payable/refunds receivable and tax expense) are recorded

based on amounts refundable or payable in the current year and include the results of any difference between GAAP and

tax reporting. Deferred income taxes reflect the tax effect of net operating losses, capital losses, general business credit

carryforwards and the net tax effects of temporary differences between the carrying amount of assets and liabilities for

financial statement and income tax purposes, based upon enacted tax laws and expected tax rates that will be in effect

when the temporary differences reverse. Valuation allowances are established when management determines that it is

more likely than not that some portion or the entire deferred tax asset will not be realized. The financial effect of changes

in tax laws or rates is accounted for in the period of enactment.

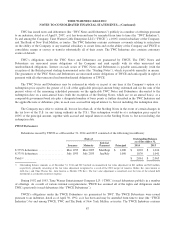

From time to time, transactions occur in which the tax consequences may be subject to uncertainty. Significant

judgment is required in assessing and estimating the tax consequences of these transactions. Income tax returns are

prepared and filed based on interpretation of tax laws and regulations. In the normal course of business, income tax

returns are subject to examination by various taxing authorities. Such examinations may result in future tax, interest and

penalty assessments by these taxing authorities. In determining the income tax provision for financial reporting purposes,

a reserve for uncertain income tax positions is established unless it is determined that such positions are more likely than

not to be sustained upon examination, based on their technical merits. There is considerable judgment involved in

determining whether positions taken on the income tax return are more likely than not to be sustained.

Income tax reserve estimates are adjusted periodically because of ongoing examinations by, and settlements with, the

various taxing authorities, as well as changes in tax laws, regulations and interpretations. The consolidated income tax

provision for any given year includes adjustments to prior year income tax accruals that are considered appropriate and

any related estimated interest. When applicable, interest and penalties are recognized on uncertain income tax positions as

part of the income tax provision.

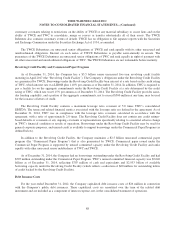

Legal Contingencies

The Company is subject to legal, regulatory and other proceedings and claims that arise in the ordinary course of

business. An estimated liability is recorded for those proceedings and claims arising in the ordinary course of business

when the loss from such proceedings and claims becomes probable and reasonably estimable. Outstanding claims are

reviewed with internal and external counsel to assess the probability and the estimates of loss, including the possible range

of an estimated loss. The risk of loss is reassessed as new information becomes available and liabilities are adjusted as

appropriate. The actual cost of resolving a claim may be substantially different from the amount of the liability recorded.

Differences between the estimated and actual amounts determined upon ultimate resolution, individually or in the

aggregate, are not expected to have a material adverse effect on the consolidated financial position but could possibly be

material to the consolidated results of operations or cash flows for any one period.

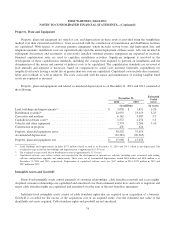

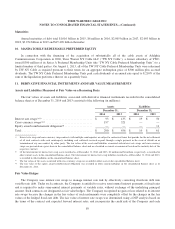

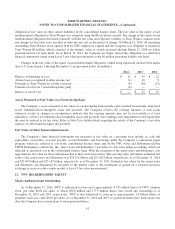

4. COMCAST MERGER

On February 12, 2014, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with

Comcast whereby the Company agreed to merge with and into a 100% owned subsidiary of Comcast (the “Comcast

merger”). Upon completion of the Comcast merger, all of the outstanding shares of the Company will be cancelled and

each issued and outstanding share will be converted into the right to receive 2.875 shares of Class A common stock of

Comcast. At their special meetings on October 8, 2014 and October 9, 2014, respectively, Comcast’s shareholders

approved the issuance of Comcast Class A common stock to TWC stockholders in the Comcast merger and TWC

stockholders approved the adoption of the Merger Agreement. TWC and Comcast expect to complete the Comcast merger

in early 2015, subject to receipt of regulatory approvals, as well as satisfaction of certain other closing conditions.

81