Time Warner Cable 2014 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)

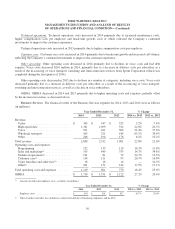

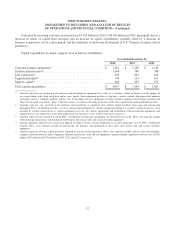

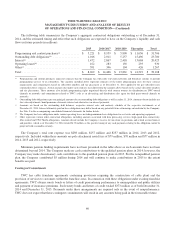

The following table summarizes the Company’s aggregate contractual obligations outstanding as of December 31,

2014, and the estimated timing and effect that such obligations are expected to have on the Company’s liquidity and cash

flows in future periods (in millions):

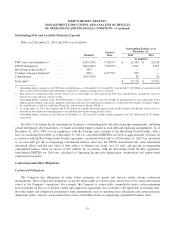

2015 2016-2017 2018-2019 Thereafter Total

Programming and content purchases(a) ............ $ 5,221 $ 8,959 $ 5,890 $ 11,636 $ 31,706

Outstanding debt obligations(b) .................. 1,016 2,011 5,257 15,496 23,780

Interest(c) ................................... 1,472 2,867 2,418 13,668 20,425

Operating leases(d) ............................ 162 283 192 293 930

Other(e) ..................................... 391 346 104 426 1,267

Total ....................................... $ 8,262 $ 14,466 $ 13,861 $ 41,519 $ 78,108

(a) Programming and content purchases represent contracts that the Company has with cable television networks and broadcast stations to provide

programming services to its subscribers. The amounts included above represent estimates of the future programming costs for these contract

requirements and commitments based on subscriber numbers and tier placement as of December 31, 2014 applied to the per-subscriber rates

contained in these contracts. Actual amounts due under such contracts may differ from the amounts above based on the actual subscriber numbers

and tier placements. These amounts also include programming rights negotiated directly with content owners for distribution on TWC-owned

channels or networks and commitments related to TWC’s role as an advertising and distribution sales agent for third party-owned channels or

networks.

(b) Outstanding debt obligations represent principal amounts due on outstanding debt obligations as of December 31, 2014. Amounts do not include any

fair value adjustments, bond premiums, discounts, interest rate derivatives or interest payments.

(c) Amounts are based on the outstanding debt balances, respective interest rates and maturity schedule of the respective instruments as of

December 31, 2014. Interest ultimately paid on these obligations may differ based on any potential future refinancings entered into by the Company.

See Note 9 to the accompanying consolidated financial statements for further details.

(d) The Company has lease obligations under various operating leases including minimum lease obligations for real estate and operating equipment.

(e) Other represents various other contractual obligations, including amounts associated with data processing services, high-speed data connectivity,

fiber-related and TWC Media obligations. Amounts do not include the Company’s reserve for uncertain tax positions and related accrued interest

and penalties, which as of December 31, 2014 totaled $132 million, as the specific timing of any cash payments relating to this obligation cannot be

projected with reasonable certainty.

The Company’s total rent expense was $298 million, $257 million and $237 million in 2014, 2013 and 2012,

respectively. Included within these amounts are pole attachment rental fees of $79 million, $70 million and $77 million in

2014, 2013 and 2012, respectively.

Minimum pension funding requirements have not been presented in the table above as such amounts have not been

determined beyond 2014. The Company made no cash contributions to the qualified pension plans in 2014; however, the

Company may make discretionary cash contributions to the qualified pension plans in 2015. For the nonqualified pension

plan, the Company contributed $5 million during 2014 and will continue to make contributions in 2015 to the extent

benefits are paid.

Contingent Commitments

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing franchise

agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and public utilities

and payment of insurance premiums. Such surety bonds and letters of credit totaled $373 million as of both December 31,

2014 and December 31, 2013. Payments under these arrangements are required only in the event of nonperformance.

TWC does not expect that these contingent commitments will result in any amounts being paid in the foreseeable future.

60