Time Warner Cable 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

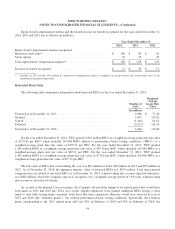

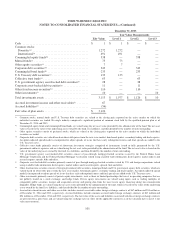

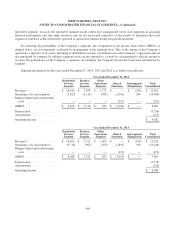

Restructuring Costs

The Company incurred restructuring costs of $27 million, $106 million and $61 million for the years ended

December 31, 2014, 2013 and 2012, respectively, primarily related to employee terminations and other exit costs. The

Company expects to incur additional restructuring costs in 2015. Changes in restructuring reserves from January 1

through December 31 are presented below (in millions):

Employee

Termination

Costs

Other

Exit

Costs Total

Remaining liability as of December 31, 2011 .......................... $ 29 $ 4 $ 33

Costs incurred .................................................. 46 15 61

Cash paid ...................................................... (51) (16) (67)

Remaining liability as of December 31, 2012 .......................... 24 3 27

Costs incurred .................................................. 88 18 106

Cash paid ...................................................... (73) (17) (90)

Remaining liability as of December 31, 2013 .......................... 39 4 43

Costs incurred .................................................. 14 16 30

Adjustments .................................................... (3) — (3)

Cash paid ...................................................... (42) (20) (62)

Remaining liability as of December 31, 2014(a) ........................ $ 8 $ — $ 8

(a) Of the remaining liability as of December 31, 2014, $6 million is classified as a current liability, with the remaining amount classified as a

noncurrent liability in the consolidated balance sheet. Amounts are expected to be paid through March 2018.

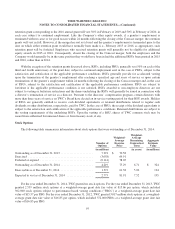

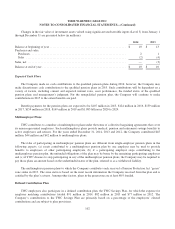

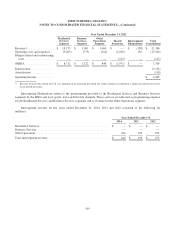

16. INCOME TAXES

The current and deferred income tax (benefit) provision for the years ended December 31, 2014, 2013 and 2012

consisted of the following (in millions):

Year Ended December 31,

2014 2013 2012

Federal:

Current ..................................................... $ 363 $ 631 $ 495

Deferred .................................................... 681 411 634

State:

Current ..................................................... 98 91 120

Deferred .................................................... 75 (48) (72)

Total ....................................................... $ 1,217 $ 1,085 $ 1,177

104