Time Warner Cable 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

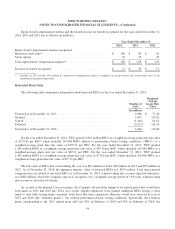

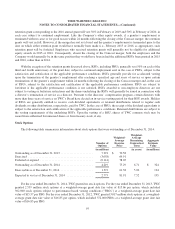

The total intrinsic value of stock options exercised during the year ended December 31, 2014, 2013 and 2012 was

$285 million, $167 million and $173 million, respectively. Cash received from stock options exercised during the year

ended December 31, 2014, 2013 and 2012 was $226 million, $138 million and $140 million, respectively, and tax benefits

realized from these exercises of stock options was $114 million, $67 million and $69 million, respectively. Total

unrecognized compensation cost related to unvested stock options as of December 31, 2014, without taking into account

expected forfeitures, was $23 million, which the Company expects to recognize over a weighted-average period of 1.77

years, without taking into account acceleration of vesting.

Stock options, including PBOs, have exercise prices equal to the fair market value of TWC common stock at the date

of grant. Generally, stock options vest ratably over a four-year vesting period and expire ten years from the date of grant,

subject to continued employment and, in the case of PBOs, subject to the satisfaction and certification of the applicable

performance condition. Certain stock option awards provide for accelerated vesting upon the termination of the grantee’s

employment after reaching a specified age and years of service or upon certain terminations of the grantee’s employment

within 24 months following the closing of the Comcast merger and, in the case of PBOs, subject to the satisfaction and

certification of the applicable performance conditions. PBOs are subject to forfeiture if the applicable performance

condition is not satisfied. Upon the exercise of a stock option, shares of TWC common stock may be issued from

authorized but unissued shares or from treasury stock, if any.

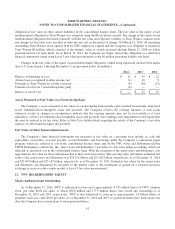

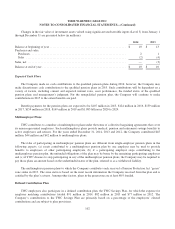

The table below presents the assumptions used to value stock options at their grant date for the years ended

December 31, 2013 and 2012 and reflects the weighted average of all awards granted within each year:

Year Ended December 31,

2013 2012

Expected volatility ............................................................. 26.14% 30.03%

Expected term to exercise from grant date (in years) .................................. 5.94 6.43

Risk-free rate ................................................................. 1.19% 1.35%

Expected dividend yield ........................................................ 2.97% 2.91%

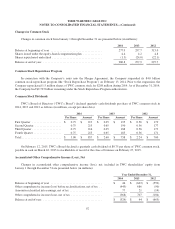

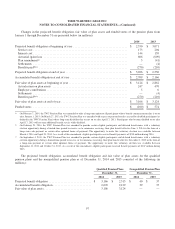

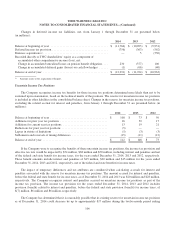

14. EMPLOYEE BENEFIT PLANS

Pension Plans

TWC sponsors the Time Warner Cable Pension Plan (the “TWC Pension Plan”) and the Time Warner Cable Union

Pension Plan (the “Union Pension Plan” and, together with the TWC Pension Plan, the “qualified pension plans”), both

qualified defined benefit pension plans, that together provide pension benefits to a majority of the Company’s employees.

TWC also provides a nonqualified defined benefit pension plan for certain employees (the “nonqualified pension plan”

and, together with the qualified pension plans, the “pension plans”). Pension benefits are based on formulas that reflect the

employees’ years of service and compensation during their employment period. TWC uses a December 31 measurement

date for its pension plans.

96