Time Warner Cable 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

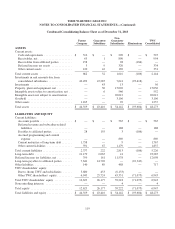

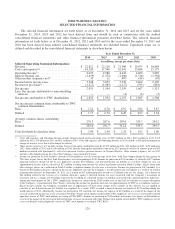

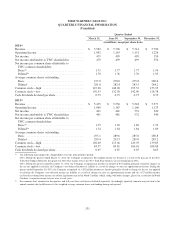

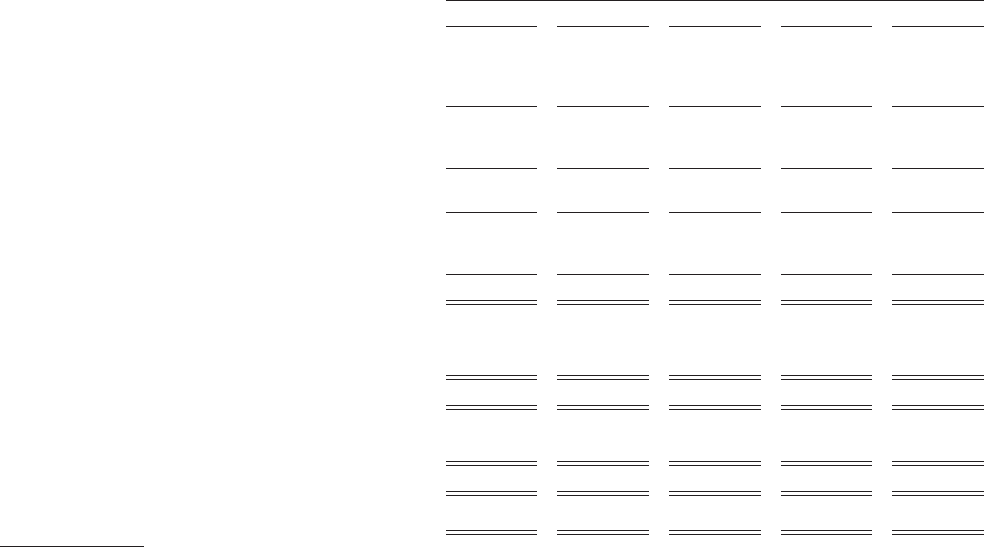

TIME WARNER CABLE INC.

SELECTED FINANCIAL INFORMATION

The selected financial information set forth below as of December 31, 2014 and 2013 and for the years ended

December 31, 2014, 2013 and 2012 has been derived from and should be read in conjunction with the audited

consolidated financial statements and other financial information presented elsewhere herein. The selected financial

information set forth below as of December 31, 2012, 2011 and 2010 and for the years ended December 31, 2011 and

2010 has been derived from audited consolidated financial statements not included herein. Capitalized terms are as

defined and described in the consolidated financial statements or elsewhere herein.

Year Ended December 31,

2014 2013 2012 2011 2010

(in millions, except per share data)

Selected Operating Statement Information:

Revenue ................................... $ 22,812 $ 22,120 $ 21,386 $ 19,675 $ 18,868

Costs and expenses(a) ......................... 18,180 17,540 16,941 15,606 15,179

Operating Income(a) .......................... 4,632 4,580 4,445 4,069 3,689

Interest expense, net .......................... (1,419) (1,552) (1,606) (1,518) (1,394)

Other income (expense), net(b) .................. 35 11 497 (89) (99)

Income before income taxes ................... 3,248 3,039 3,336 2,462 2,196

Income tax provision(c) ........................ (1,217) (1,085) (1,177) (795) (883)

Net income ................................. 2,031 1,954 2,159 1,667 1,313

Less: Net income attributable to noncontrolling

interests ................................. — — (4) (2) (5)

Net income attributable to TWC shareholders ..... $ 2,031 $ 1,954 $ 2,155 $ 1,665 $ 1,308

Net income per common share attributable to TWC

common shareholders:

Basic ...................................... $ 7.21 $ 6.76 $ 6.97 $ 5.02 $ 3.67

Diluted .................................... $ 7.17 $ 6.70 $ 6.90 $ 4.97 $ 3.64

Average common shares outstanding:

Basic ...................................... 279.3 287.6 307.8 329.7 354.2

Diluted .................................... 283.0 291.7 312.4 335.3 359.5

Cash dividends declared per share ............... $ 3.00 $ 2.60 $ 2.24 $ 1.92 $ 1.60

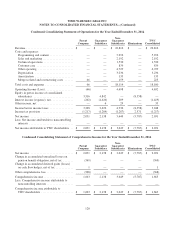

(a) Costs and expenses and Operating Income include merger-related and restructuring costs of $225 million in 2014, $119 million in 2013, $115

million in 2012, $70 million in 2011 and $52 million in 2010. Costs and expenses and Operating Income in 2011 includes a $60 million impairment

charge on wireless assets that will no longer be utilized.

(b) Other income (expense), net, includes income (losses) from equity-method investments of $33 million in 2014, $19 million in 2013, $454 million in

2012, $(88) million in 2011 and $(110) million in 2010. Income from equity-method investments in 2012 primarily consists of a pretax gain of $430

million associated with SpectrumCo’s sale of its advanced wireless spectrum licenses to Verizon Wireless. Other income (expense), net, in 2012

includes a $64 million gain on the sale of the Company’s investment in Clearwire.

(c) Income tax provision in 2014 includes a benefit of $24 million as a result of the passage of the New York State budget during the first quarter of

2014 that, in part, lowers the New York State business tax rate beginning in 2016. Income tax provision in 2013 includes (i) a benefit of $77 million

primarily related to changes in the tax rate applied to calculate the Company’s net deferred income tax liability as a result of changes in state tax

apportionment factors and (ii) a benefit of $27 million resulting from income tax reform legislation enacted in North Carolina, which, along with

other changes, phases in a reduction in North Carolina’s corporate income tax rate over several years. Income tax provision in 2012 includes (i) a

benefit of $63 million related to a change in the tax rate applied to calculate the Company’s net deferred income tax liability as a result of an internal

reorganization effective on September 30, 2012, (ii) a benefit of $47 million primarily related to a California state tax law change, (iii) a benefit of

$46 million related to the reversal of a valuation allowance against a deferred income tax asset associated with the Company’s investment in

Clearwire and (iv) a charge of $15 million related to the recording of a deferred income tax liability associated with a partnership basis difference.

During the fourth quarter of 2011, TWC completed its income tax returns for the 2010 taxable year, its first full-year income tax returns subsequent

to the Company’s separation from Time Warner, reflecting the income tax positions and state tax apportionments of TWC as a standalone taxpayer.

Based on these returns, the Company concluded that an approximate 65 basis point change in the estimate of the effective tax rate applied to

calculate its net deferred income tax liability was required. As a result, TWC recorded a noncash income tax benefit of $178 million during the

fourth quarter of 2011. Additionally, income tax provision in 2011 includes net income tax expense of $14 million as a result of the impact of the

reversal of deferred income tax assets associated with Time Warner stock option awards held by TWC employees, net of excess tax benefits realized

upon the exercise of TWC stock options or vesting of TWC RSUs. Income tax provision in 2010 includes net income tax expense of $68 million as

a result of the impact of the reversal of deferred income tax assets associated with Time Warner stock option awards held by TWC employees, net of

excess tax benefits realized upon the exercise of TWC stock options or vesting of TWC RSUs.

129