Time Warner Cable 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

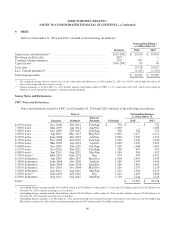

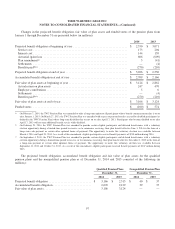

Maturities

Annual maturities of debt total $1.016 billion in 2015, $6 million in 2016, $2.005 billion in 2017, $2.003 billion in

2018, $3.254 billion in 2019 and $15.496 billion thereafter.

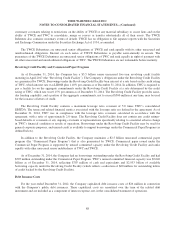

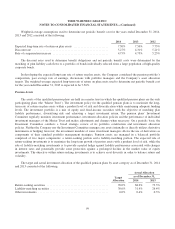

10. MANDATORILY REDEEMABLE PREFERRED EQUITY

In connection with the financing of the acquisition of substantially all of the cable assets of Adelphia

Communications Corporation in 2006, Time Warner NY Cable LLC (“TW NY Cable”), a former subsidiary of TWC,

issued $300 million of its Series A Preferred Membership Units (the “TW NY Cable Preferred Membership Units”) to a

limited number of third parties. On August 1, 2013, all of the TW NY Cable Preferred Membership Units were redeemed

by TW NY Cable as required pursuant to their terms for an aggregate redemption price of $300 million plus accrued

dividends. The TW NY Cable Preferred Membership Units paid cash dividends at an annual rate equal to 8.210% of the

sum of the liquidation preference thereof on a quarterly basis.

11. DERIVATIVE FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS

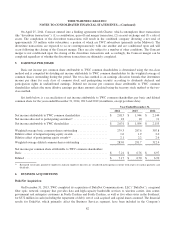

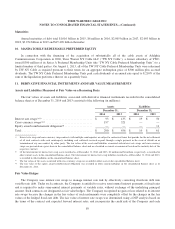

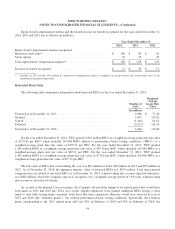

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The fair values of assets and liabilities associated with derivative financial instruments recorded in the consolidated

balance sheet as of December 31, 2014 and 2013 consisted of the following (in millions):

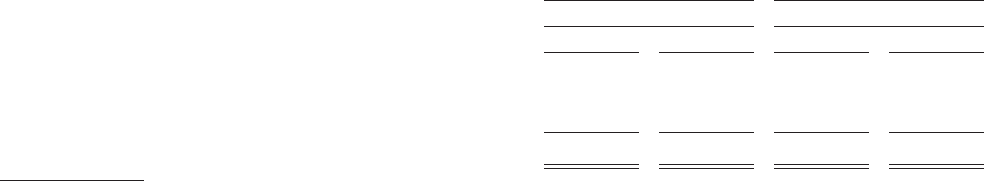

Assets Liabilities

December 31, December 31,

2014 2013 2014 2013

Interest rate swaps(a)(b) .................................. $ 93 $ 135 $ 19 $ 50

Cross-currency swaps(a)(c) ............................... 197 321 — —

Equity award reimbursement obligation(d) ................... ———11

Total ................................................ $ 290 $ 456 $ 19 $ 61

(a) Interest rate swap and cross-currency swap contracts with multiple counterparties are subject to contractual terms that provide for the net settlement

of all such contracts with each counterparty, including cash collateral received or paid, through a single payment in the event of default on or

termination of any one contract by either party. The fair values of the assets and liabilities associated with interest rate swaps and cross-currency

swaps are presented on a gross basis in the consolidated balance sheet and are classified as current or noncurrent based on the maturity date of the

respective contract.

(b) Of the total amount of interest rate swap assets recorded as of December 31, 2014 and 2013, $1 million and $8 million, respectively, is recorded in

other current assets in the consolidated balance sheet. The total amount of interest rate swap liabilities recorded as of December 31, 2014 and 2013,

is recorded in other liabilities in the consolidated balance sheet.

(c) The fair values of the assets associated with cross-currency swaps are recorded in other assets in the consolidated balance sheet.

(d) The fair value of the equity award reimbursement obligation was recorded in other current liabilities in the consolidated balance sheet as of

December 31, 2013.

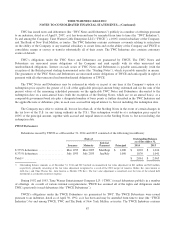

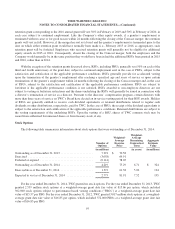

Fair Value Hedges

The Company uses interest rate swaps to manage interest rate risk by effectively converting fixed-rate debt into

variable-rate debt. Under such contracts, the Company is entitled to receive semi-annual interest payments at fixed rates

and is required to make semi-annual interest payments at variable rates, without exchange of the underlying principal

amount. Such contracts are designated as fair value hedges. The Company recognized no gain or loss related to its interest

rate swaps because the changes in the fair values of such instruments were completely offset by the changes in the fair

values of the hedged fixed-rate debt. The fair value of interest rate swaps was determined using a DCF analysis based on

the terms of the contract and expected forward interest rates, and incorporates the credit risk of the Company and each

89