Time Warner Cable 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

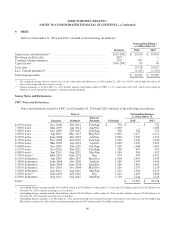

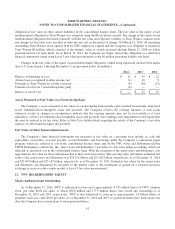

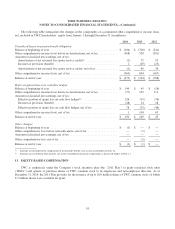

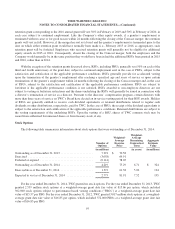

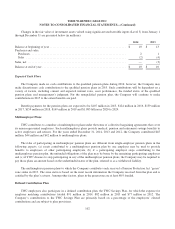

The following table summarizes the changes in the components of accumulated other comprehensive income (loss),

net, included in TWC shareholders’ equity from January 1 through December 31 (in millions):

2014 2013 2012

Unrealized losses on pension benefit obligation:

Balance at beginning of year ............................................. $ (104) $ (708) $ (541)

Other comprehensive income (loss) before reclassifications, net of tax ............ (368) 558 (201)

Amounts reclassified into earnings, net of tax:

Amortization of net actuarial loss (prior service credit)(a) ..................... (2) 75 59

Income tax provision (benefit) .......................................... 1 (29) (25)

Amortization of net actuarial loss (prior service credit), net of tax .............. (1) 46 34

Other comprehensive income (loss), net of tax ............................... (369) 604 (167)

Balance at end of year .................................................. $ (473) $ (104) $ (708)

Deferred gains (losses) on cash flow hedges:

Balance at beginning of year ............................................. $ 149 $ 45 $ (18)

Other comprehensive income (loss) before reclassifications, net of tax ............ (77) 129 111

Amounts reclassified into earnings, net of tax:

Effective portion of (gain) loss on cash flow hedges(b) ....................... 126 (39) (76)

Income tax provision (benefit) .......................................... (48) 14 28

Effective portion of (gain) loss on cash flow hedges, net of tax ................ 78 (25) (48)

Other comprehensive income (loss), net of tax ............................... 1 104 63

Balance at end of year .................................................. $ 150 $ 149 $ 45

Other changes:

Balance at beginning of year ............................................. $ (1) $ — $ —

Other comprehensive loss before reclassifications, net of tax .................... — (1) —

Amounts reclassified into earnings, net of tax ................................ — — —

Other comprehensive loss, net of tax ....................................... — (1) —

Balance at end of year .................................................. $ (1) $ (1) $ —

(a) Amounts are included in the computation of net periodic benefit costs as discussed further in Note 14.

(b) Amounts are recorded in other income, net in the consolidated statement of operations as discussed further in Note 11.

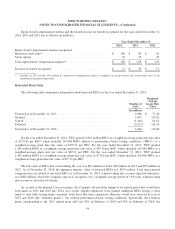

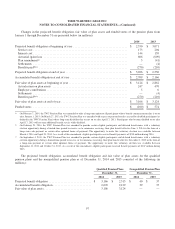

13. EQUITY-BASED COMPENSATION

TWC is authorized, under the Company’s stock incentive plan (the “2011 Plan”) to grant restricted stock units

(“RSUs”) and options to purchase shares of TWC common stock to its employees and non-employee directors. As of

December 31, 2014, the 2011 Plan provides for the issuance of up to 20.0 million shares of TWC common stock, of which

8.7 million shares were available for grant.

93