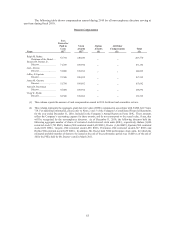

Priceline 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

Certain Relationships and Related Transactions

Review and Approval or Ratification of Related Party Transactions.

The Audit Committee of the Board of Directors, pursuant to a written policy, reviews all relationships

and transactions in which the Company participates and in which any related person has a direct or indirect

material interest and the transaction involves or is expected to involve payments of $120,000 or more in the

aggregate per fiscal year. The Company’s legal staff is primarily responsible for gathering information from the

directors and executive officers. Related person transactions are generally identified in:

¾ questionnaires annually distributed to the Company’s directors and executive officers;

¾ certifications submitted annually by the Company’s executive officers and directors related to their

compliance with the Company’s Code of Business Conduct and Ethics; and

¾ communication made directly by the related person to the General Counsel.

As required under SEC rules, transactions that are determined to be directly or indirectly material to the

Company or a related person for which disclosure is required are disclosed in the Company’s proxy statement.

In addition, the Audit Committee reviews and approves or ratifies any related person transaction that is required

to be disclosed. In the course of its review and approval or ratification of a disclosable related party transaction,

the Audit Committee will consider:

¾ the nature of the related person’s interest in the transaction;

¾ the material terms of the transaction, including, without limitation, the amount and type of transaction;

¾ the importance of the transaction to the related person;

¾ the importance of the transaction to the Company;

¾ whether the transaction would impair the judgment of a director or executive officer to act in the best

interest of the Company; and

¾ any other matters the committee deems appropriate.

Any member of the Audit Committee who is a related person with respect to a transaction under review

may not participate in the deliberations or vote respecting approval or ratification of the transaction; provided,

however, that such director may be counted in determining the presence of a quorum at a meeting that considers

the transaction. This process is included in the Company’s Corporate Governance Principles, which is available

on the Investor Relations section of the Company’s website (www.priceline.com) under the tab “Corporate

Governance.”

Club Quarters

Ralph Bahna, Chairman of the Company’s Board of Directors, has been a stakeholder in and President

of Masterworks Development Corp., which has developed an international group of hotels named Club Quarters,

since 1992. During the year ended December 31, 2010, priceline.com facilitated the sale of Club Quarters’ hotel

room nights to customers. The room nights sold by Club Quarters to priceline.com customers (including

customers of the company’s subsidiaries) during 2010 represented less than 0.20% of the total hotel room nights

sold by all hotel suppliers through priceline.com, including its subsidiaries, during 2010. Club Quarters received

approximately $14.1 million of bookings through priceline.com (and its subsidiaries) in 2010, approximately

$5.9 million of which was paid by priceline.com to Club Quarters in connection with “merchant” hotel

transactions. The approximately $5.9 million paid to Club Quarters by priceline.com in 2010 represented less

than 5% of Club Quarters’ consolidated gross revenues in 2010.

Jeffrey E. Epstein

Jeffrey E. Epstein, a director of priceline.com and member of its Audit Committee and Compensation

Committee, was the Executive Vice President and Chief Financial Officer of Oracle Corporation during 2010.

The Company purchases or licenses certain software and other related services from Oracle Corporation in the

ordinary course of business. In 2010, the Company paid Oracle Corporation approximately $1 million in

connection with such software and other related services. Priceline.com’s relationship with Oracle Corporation

was in existence before Mr. Epstein joined Oracle Corporation.