Priceline 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

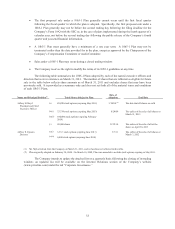

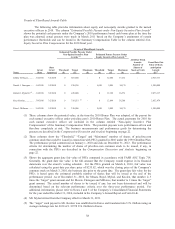

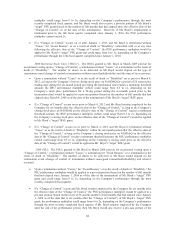

Grants of Plan-Based Awards Table

The following table provides information about equity and non-equity awards granted to the named

executive officers in 2010. The column “Estimated Possible Payouts under Non-Equity Incentive Plan Awards”

shows the potential cash payouts under the Company’s 2010 performance based cash bonus plan at the time the

plan was adopted; actual payouts were made in March 2011 based on the Company’s attainment of certain

performance thresholds and can be found in the Summary Compensation Table in the column entitled Non-

Equity Incentive Plan Compensation for the 2010 fiscal year.

Grants of Plan-Based Awards

Estimated Possible Payouts Under

Non-Equity Incentive Plan

Awards (1)

Estimated Future Payouts Under

Equity Incentive Plan Awards (2)

Name

Grant

Date

Date

Grant

Approved

Threshold

($)

Target

($)

Maximum

($)

Threshold

(#)

Target

(#)

Maximum

(#)

All Other Stock

Awards:

Number of

Shares of

Stock or Units

(#)

Grant Date Fair

Value of Stock

and Option

Awards

($)(3)

Jeffery H. Boyd ..........

.

3/4/2010

3/2/2010

0

687,500

-

0

12,404

37,212

-

2,925,111

Daniel J. Finnegan. ....

.

3/4/2010

3/2/2010

0

236,250

-

5,089

5,089

10,178

-

1,200,088

Robert J. Mylod Jr.(4) .

.

3/4/2010

3/2/2010

0

420,000

-

0

12,192

36,576

-

2,875,117

Kees Koolen ...............

.

3/4/2010

3/2/2010

0

319,531 (5)

-

0

12,096

36,288

-

2,852,479

Peter J. Millones ........

.

3/4/2010

3/2/2010

0

330,000

-

5,089

5,089

10,178

-

1,200,088

(1) These columns show the potential value, at the time the 2010 Bonus Plan was adopted, of the payout for

each named executive officer under priceline.com’s 2010 Bonus Plan. The actual payments for 2010 for

each named executive officer are included in the column entitled “Non-equity Incentive Plan

Compensation” of the Summary Compensation Table. The potential payouts were performance-driven and

therefore completely at risk. The business measurements and performance goals for determining the

payouts are described in the Compensation Discussion and Analysis beginning on page 22.

(2) These columns show the “Threshold,” “Target” and “Maximum” number of shares of priceline.com

common stock that could be issued in connection with PSUs granted in 2010 under the 1999 Omnibus Plan.

The performance period commenced on January 1, 2010 and ends on December 31, 2012. The performance

criteria for determining the number of shares of priceline.com common stock to be issued, if any, in

connection with the PSUs are described in the Compensation Discussion and Analysis beginning on

page 22.

(3) Shows the aggregate grant date fair value of PSUs computed in accordance with FASB ASC Topic 718.

Generally, the grant date fair value is the full amount that the Company would expense in its financial

statements over the award’s vesting schedule. For the PSUs granted on March 4, 2010, fair value was

calculated using the grant date per share price of $235.82, which was the closing price of the Company’s

common stock on March 3, 2010, the business day prior to the grant date. The grant date fair value for the

PSUs is based upon the estimated probable number of shares that will be issued at the end of the

performance period. As of December 31, 2010, for Messrs. Boyd, Mylod, and Koolen, that number is 3

times the “target” grant amount and for Messrs. Finnegan and Millones, that number is 2 times the “target”

grant amount. The actual number of shares to be issued, if any, has not been determined and will be

determined based on the relevant performance criteria over the three-year performance period. For

additional information, please refer to Notes 2 and 3 of the Company’s Consolidated Financial Statements

for the year ended December 31, 2010, included in the Company’s Annual Report on Form 10-K.

(4) Mr. Mylod retired from the Company effective March 31, 2011.

(5) The “target” cash payout to Mr. Koolen was established in Euros and translated into U.S. Dollars using an

average exchange rate for 2010 of 1.32728 U.S. Dollars to Euros.