Priceline 2010 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

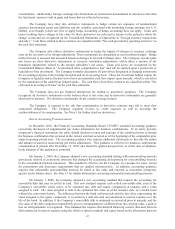

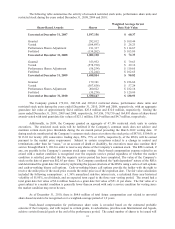

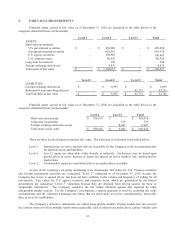

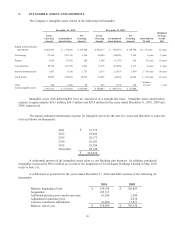

5. FAIR VALUE MEASUREMENTS

Financial assets carried at fair value as of December 31, 2010 are classified in the table below in the

categories described below (in thousands):

Level 1 Level 2 Level 3 Total

ASSETS:

Short-term investments

U.S. government securities $ - $ 469,208 $ - $ 469,208

Foreign government securities - 683,318 - 683,318

U.S. agency securities - 109,905 - 109,905

U.S. corporate notes - 40,820 - 40,820

Long-term investments - 394 - 394

Foreign exchange derivatives - 4,970 - 4,970

Total assets at fair value $ - $ 1,308,615 $ - $ 1,308,615

Level 1 Level 2 Level 3 Total

LIABILITIES:

Foreign exchange derivatives $ - $ 6,995 $ - $ 6,995

Redeemable noncontrolling interests - - 45,751 45,751

Total liabilities at fair value $ - $ 6,995 $ 45,751 $ 52,746

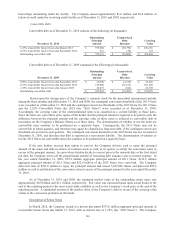

Financial assets carried at fair value as of December 31, 2009 are classified in the table below in the

categories described below (in thousands):

Level 1 Level 2 Total

Short-term investments $ 598,014 $ - $ 598,014

Long-term investments - 359 359

Foreign exchange derivative assets - 8,047 8,047

Total assets at fair value $ 598,014 $ 8,406 $ 606,420

There are three levels of inputs to measure fair value. The definition of each input is described below:

Level 1: Quoted prices in active markets that are accessible by the Company at the measurement date

for identical assets and liabilities.

Level 2: Level 2 inputs are observable, either directly or indirectly. Such prices may be based upon

quoted prices in active markets or inputs not quoted on active markets, but corroborated by

market data.

Level 3: Unobservable inputs are used when little or no market data is available.

As part of the Company’s on-going monitoring of its investments, fair values for U.S. Treasury securities

and foreign government securities are considered “Level 2” valuations as of December 31, 2010 because the

Company has access to quoted prices, but does not have visibility to the volume and frequency of trading for all

investments. Fair values for U.S. agency securities and corporate notes, which are guaranteed by the federal

government, are considered “Level 2” valuations because they are obtained from pricing sources for these or

comparable instruments. The Company compares the fair values obtained against data reported by other

independent market sources. For the Company’s investments, a market approach is used for recurring fair value

measurements and the valuation techniques use inputs that are observable, or can be corroborated by observable

data, in an active marketplace.

The Company’s derivative instruments are valued using pricing models. Pricing models take into account

the contract terms as well as multiple inputs where applicable, such as interest rate yield curves, option volatility and