Priceline 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

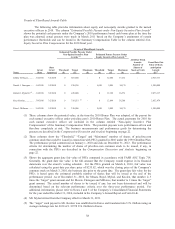

Equity Issuance Dates

For 2011, the Committee selected March 4, May 13, August 12 and November 14 as the dates of grant

for any equity issuances (to the extent the Committee authorizes any issuances) to executives and employees in

2011. The Committee reserves the right to adjust dates in advance or select additional grant dates in its sole

discretion. All grants are or will be, as applicable, approved in advance by the Committee or, on an exception

basis, the Chairperson of the Compensation Committee.

Clawbacks

The Company intends to adopt a policy with respect to the “clawback” of executive compensation at

such time as the Securities and Exchange Commission releases final rules on the matter.

Deductibility Cap on Executive Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended, provides that compensation in

excess of $1,000,000 paid to each “covered employee” (generally, the chief executive officer and the three other

highest paid executive officers other than the chief financial officer) will not be deductible for federal income tax

purposes unless such compensation is paid pursuant to one of the enumerated exceptions set forth in Section

162(m). The Committee’s primary objective in designing and administering priceline.com’s compensation

policies is to support and encourage the achievement of the Company’s long-term strategic goals and to enhance

stockholder value, all as described above. When consistent with this compensation philosophy, the Committee

also intends to structure the Company’s compensation programs such that compensation paid thereunder will be

tax deductible by the Company. The Committee believes that stockholder interests are best served by not

restricting the Committee’s discretion and flexibility in crafting compensation programs, even though such

programs may result in certain non-deductible compensation expenses. Accordingly, the Committee has

approved, and may in the future approve, compensation arrangements for executive officers that are not fully

deductible.

For example, payments under the 2010 Bonus Plan, which were funded as the result of significant year-

over-year earnings growth, are not deductible under Section 162(m) because the 2010 Bonus Plan allowed the

Committee to exercise its discretion to make adjustments to what was included or excluded from the non-GAAP

EBITDA metric – discretion that is intended to ensure that the results measured in the bonus plan represent the

underlying growth of priceline.com’s core business.