Priceline 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Priceline.com adds a cash match to its 401(k) plan for all participants, including those executive officers who

participate in the plan. Priceline.com matches 50% of the first 6% of compensation deferred as contributions.

The 401(k) match made to each of the U.S.-based named executive officers is reflected in the All Other

Compensation column on the Summary Compensation Table.

Perquisites

Priceline.com does not maintain any material perquisites or personal benefits for any of the named

executive officers, such as company planes, cars, security or financial services or country club memberships.

Other Matters

Stock Ownership Guidelines

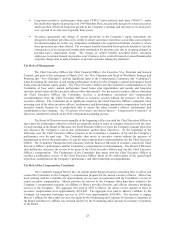

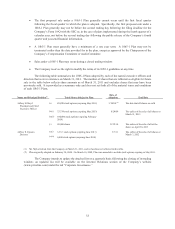

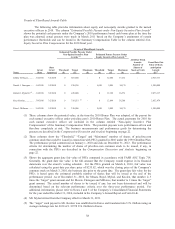

Under the Company’s stock ownership guidelines, each named executive officer of the Company is

required to own the number of shares of the Company’s common stock indicated below. Mr. Mylod retired from

the Company on March 31, 2011, and is therefore not reflected in the table below.

Name

Number of Shares Required to be

Owned under the Company’s Stock

Ownership Guidelines – the Lesser of:

Number of Shares

Actually Owned

as of March 31, 2011(1)

Jeffery H. Boyd, President

and Chief Executive

Officer

15,000 shares or shares valued

at $5 million

221,260

Daniel J. Finnegan,

Chief Financial Officer

5,000 shares or shares valued at three (3)

times base salary

11,345

Kees Koolen,

Chief Executive Officer,

Booking.com B.V.

5,000 shares or shares valued at three (3)

times base salary

24,011

Peter J. Millones, General Counsel,

Corporate Secretary and Executive

Vice President

5,000 shares or shares valued at three (3)

times base salary

10,003

(1) See “Security Ownership of Certain Beneficial Owners and Management” on page 20 for full details

relating to actual stock ownership.

The Company’s stock ownership guidelines also set forth requirements for non-employee member of

the Board of Directors, which are set forth under “Director Compensation,” beginning on page 54. The

Company’s stock ownership guidelines are detailed in the Company’s Corporate Governance Principles, a copy

of which is available on the Investor Relations section of the Company’s website (www.priceline.com) under the

tab “Corporate Governance.”

Short-Selling Prohibition

The Company does not allow its executives to speculate in the Company’s stock, which includes, but is

not limited to, short selling (profiting if the market price of the securities decreases) and/or buying or selling

publicly traded options, including writing covered calls.

Pre-arranged trading plans

The Company encourages, but does not require, each of its executive officers to dispose of shares of the

Company’s common stock pursuant to a pre-arranged trading plan adopted in compliance with Rule 10b5-1

under the Securities Exchange Act of 1934 (a “10b5-1 Plan”). The Company has established guidelines for the

adoption and implementation of 10b5-1 Plans, including without limitation:

x A 10b5-1 Plan must be adopted during an open trading window.