Priceline 2010 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

December 15, 2008. The adoption of this standard may change the Company’s accounting treatment for future

business combinations.

3. STOCK-BASED COMPENSATION AND OTHER STOCK-BASED PAYMENTS

The Company has adopted the priceline.com Incorporated 1999 Omnibus Plan, as amended and restated

effective June 4, 2008, (the “1999 Plan”) as the stock compensation plan from which broad-based employee grants

may be made. The 1999 Plan provides for stock-based compensation grants of up to 9,195,833 shares of

priceline.com Incorporated common stock as incentives and rewards to encourage employees, officers, consultants

and directors to contribute to the long-term success of the Company. As of December 31, 2010, there are 806,763

shares available to be issued under the plan.

Stock-based compensation issued under the plans generally consists of restricted stock units, performance

share units, restricted stock and non-qualified stock options. Stock options are granted to employees at exercise

prices equal to the fair value of the common stock at the date of grant and have a term of 10 years. Generally, stock

option grants to employees vest over three years from the grant date. Restricted stock, performance share units and

restricted stock units generally vest over periods from 1 to 4 years. The Company issues new shares of common

stock upon the issuance of restricted stock, the exercise of stock options and the vesting of restricted stock units and

performance share units.

Stock-based compensation included in personnel expenses in the Consolidated Statements of Operations

was approximately $68.2 million, $40.7 million and $40.5 million for the years ended December 31, 2010, 2009 and

2008, respectively. Stock-based compensation for the year ended December 31, 2010 includes charges amounting

to $13.4 million representing the cumulative impact of adjusting the estimated probable outcome at the end of the

performance period for certain outstanding unvested performance share units. Included in the stock-based

compensation are approximately $1.3 million, $1.1 million, and $0.9 million for the years ended December 31,

2010, 2009, and 2008, respectively, for grants to non-employee directors. The related tax benefit for stock-based

compensation is $7.5 million, $4.9 million and $6.3 million for the years ended December 31, 2010, 2009 and 2008,

respectively. Also included in the above amounts for the year ended December 31, 2008 is stock-based

compensation and related tax benefits for restricted stock and restricted stock units related to shares of priceline.com

International.

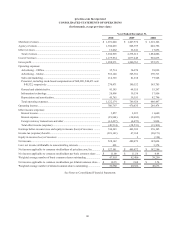

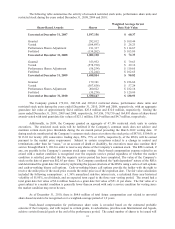

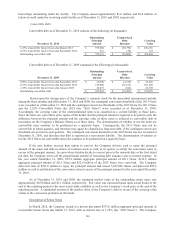

The following table summarizes stock option activity during the year ended December 31, 2010:

Stock Options

Shares

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(000’s)

Outstanding at December 31, 2009 920,299 $ 91.41 2.4 $ 132,519

Exercised (407,461) $ 63.20

Expired (157,370) $ 317.66

Outstanding at December 31, 2010 355,468 $ 23.59 2.6 $ 133,641

No stock options were granted during the years ended December 31, 2010, 2009 or 2008. The intrinsic

value of stock options exercised was approximately $74.8 million, $61.9 million and $23.2 million for the years

ended December 31, 2010, 2009 and 2008, respectively. As of December 31, 2008, all stock options were fully

vested and exercisable.