Priceline 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

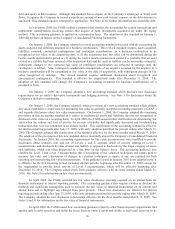

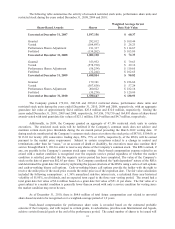

81

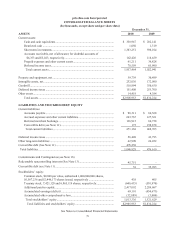

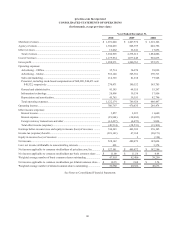

priceline.com Incorporated

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2010, 2009 and 2008

(In thousands)

Additional Accumulated Accumulated Other

Common Stock Treasury Stock Paid-in Earnings Comprehensive Comprehensive

Shares Amount Shares Amount Capital (Deficit) Income (Loss) Income Total

Balance, December 31, 2007 45,118 $ 346 (6,646) $ (489,106) $ 2,018,432 $ (1,126,391) $ 50,344 $ 453,625

Net income applicable to common stockholders - - - - - 182,246 - $ 182,246

Unrealized gain on marketable securities, net of tax of $0 - - - - - - 260 260

Currency translation adjustment, net of tax of $0 - - - - - - (91,001) (91,001)

Comprehensive income $ 91,505 91,505

Reversal of redeemable noncontrolling interests fair value

adjustments upon redemption of remaining shares - - - - 77,442 - -

77,442

Reclassification adjustment for convertible debt in mezzanine - - - - 26,669 - - 26,669

Exercise of stock options and vesting of restricted stock units

and/or performance shares 283 2 - - 5,505 - -

5,507

Repurchase of common stock - - (39) (4,449) - - - (4,449)

Stock-based compensation and other stock based payments - - - - 40,448 - - 40,448

Conversion of debt 2,264 19 - - 1,023 - - 1,042

Excess tax benefit from stock-based compensation - - - - 7,037 - - 7,037

Balance, December 31, 2008 47,665 $ 367 (6,685) $ (493,555) $ 2,176,556 $ ( 944,145) $ (40,397) $ 698,826

Net income applicable to common stockholders - - - - - 489,472 - $ 489,472

Unrealized gain on marketable securities, net of tax of $0 - - - - - - 116 116

Currency translation adjustment, net of tax of $1,209 - - - - - - 37,281 37,281

Comprehensive income $ 526,869 526,869

Restricted stock forfeitures (3) - - - - - - -

Reclassification adjustment for convertible debt in mezzanine - - - - 18,203 - - 18,203

Exercise of stock options and vesting of restricted stock units

and/ or performance shares 1,200 9 - - 43,419 - -

43,428

Repurchase of common stock - - (180) (17,415) - - - (17,415)

Stock-based compensation and other stock based payments - - - - 40,671 - - 40,671

Conversion of debt 3,584 29 - - 8,869 - - 8,898

Excess tax benefit from stock-based compensation - - - - 2,149 - - 2,149

Balance, December 31, 2009 52,446 $ 405 (6,865) $ (510,970) $ 2,289,867 $ (454,673) $ (3,000) $ 1,321,629

Net income applicable to common stockholders - - - - - 527,541 - $ 527,541

Redeemable noncontrolling interests fair value adjustment - - - - - (3,758) - (3,758)

Unrealized gain on marketable securities, net of tax of $175 - - - - - - 294 294

Currency translation adjustment, net of tax of $11,311 - - - - - - (30,183) (30,183)

Comprehensive income $ 493,894 493,894

Redeemable noncontrolling interests fair value adjustments - - - - (4,118) - - (4,118)

Proceeds from the termination of conversion spread hedges 42,984 42,984

Reclassification adjustment for convertible debt in mezzanine - - - - 3,683 - - 3,683

Exercise of stock options and vesting of restricted stock units

and/or performance shares 663 5 - - 25,746 - -

25,751

Repurchase of common stock - - (556) (129,445) - - - (129,445)

Stock-based compensation and other stock-based payments - - - - 68,396 - - 68,396

Issuance of senior convertible notes - - - - 67,516 - - 67,516

Conversion of debt 3,458 28 - - (80,073) - - (80,045)

Excess tax benefit from stock-based compensation - - - - 3,091 - - 3,091

Balance, December 31, 2010 56,567 $ 438 (7,421) $ (640,415) $ 2,417,092 $ 69,110 $ (32,889) $ 1,813,336

See Notes to Consolidated Financial Statements.