Priceline 2010 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Sales of Unregistered Securities

In 2010, we issued 491,724 shares of our common stock to holders of our 2.25% Convertible Senior Notes

upon the conversion of approximately $22.9 million principal amount of notes; we issued 419,818 shares of our

common stock to holders of our 2011 Notes upon the conversion of approximately $39.9 million principal amount

of notes; and we issued 2,546,286 shares of our common stock to holders of our 2013 Notes upon conversion of

approximately $132.8 million principal amount of notes. Such issuances of shares of our common stock were made

under Section 4(2) of the Securities Act of 1933, as amended. See Note 11 to the Consolidated Financial

Statements.

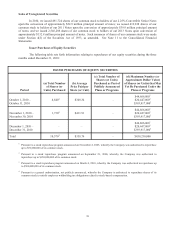

Issuer Purchases of Equity Securities

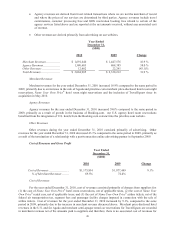

The following table sets forth information relating to repurchases of our equity securities during the three

months ended December 31, 2010:

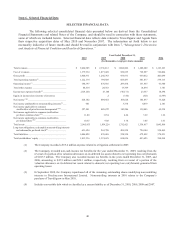

ISSUER PURCHASES OF EQUITY SECURITIES

Period

(a) Total Number

of Shares (or

Units) Purchased

(b) Average

Price Paid per

Share (or Unit)

(c) Total Number of

Shares (or Units)

Purchased as Part of

Publicly Announced

Plans or Programs

(d) Maximum Number (or

Approximate Dollar Value)

of Shares (or Units) that May

Yet Be Purchased Under the

Plans or Programs

October 1, 2010 –

October 31, 2010

8,8404 $348.34 –

$44,866,0001

$20,447,0002

$393,917,0003

November 1, 2010 –

November 30, 2010

1,7304 $411.91 –

$44,866,0001

$20,447,0002

$393,917,0003

December 1, 2010 –

December 31, 2010

– – –

$44,866,0001

$20,447,0002

$393,917,0003

Total 10,5704 $358.74 – $459,230,000

1 Pursuant to a stock repurchase program announced on November 2, 2005, whereby the Company was authorized to repurchase

up to $50,000,000 of its common stock.

2 Pursuant to a stock repurchase program announced on September 21, 2006, whereby the Company was authorized to

repurchase up to $150,000,000 of its common stock.

3 Pursuant to a stock repurchase program announced on March 4, 2010, whereby the Company was authorized to repurchase up

to $500,000,000 of its common stock.

4 Pursuant to a general authorization, not publicly announced, whereby the Company is authorized to repurchase shares of its

common stock to satisfy employee withholding tax obligations related to stock-based compensation.