Priceline 2010 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2010 Priceline annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.88

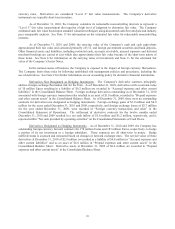

debt and equity at debt issuance. Although this standard has no impact on the Company’s actual past or future cash

flows, it requires the Company to record a significant amount of non-cash interest expense as the debt discount is

amortized. This standard requires retrospective application. See Note 11 for further information on convertible debt.

In November 2008, the FASB ratified a proposal that clarifies the accounting for certain transactions and

impairment considerations involving entities that acquire or hold investments accounted for under the equity

method. This accounting guidance is applied on a prospective basis. The adoption of this standard on January 1,

2009 did not have an impact on the Company’s Consolidated Financial Statements.

On January 1, 2009, the Company adopted a revised accounting standard associated with the accounting for

assets acquired and liabilities assumed in a business combination. This revised standard requires assets acquired,

liabilities assumed, contractual contingencies and contingent consideration in a business combination to be

recognized at fair value, at the acquisition date, if (1) the acquisition-date fair value can be determined during the

twelve month measurement period or (2) during the twelve month measurement period it is probable that an asset

existed or a liability had been incurred at the acquisition date and the asset or liability can be reasonably estimated.

Subsequent changes to the estimated fair value of contingent consideration are reflected in earnings until the

contingency is settled. Also, contingent consideration arrangements of an acquiree assumed by the acquirer in a

business combination will be recognized at fair value at the date of acquisition, with subsequent changes in fair

value recognized in earnings. The revised standard requires additional disclosures about recognized and

unrecognized contingencies. This standard is effective for acquisitions made after December 31, 2008. The

adoption of this standard will change the Company’s accounting treatment for business combinations on a

prospective basis.

On January 1, 2009, the Company adopted a new accounting standard which provides new disclosure

requirements for an entity’s derivative instruments and hedging activities. See Note 5 for disclosures about the

Company’s derivative instruments.

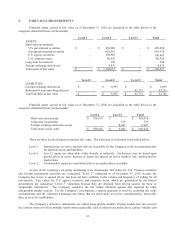

On January 1, 2008, the Company adopted certain provisions of a new accounting standard which defines

fair value, establishes a framework for measuring fair value in generally accepted accounting principles (“GAAP”)

and expands disclosures about fair value measurements. On January 1, 2009, the Company adopted the remaining

provisions of this accounting standard as it relates to nonfinancial assets and liabilities that are not recognized or

disclosed at fair value on a recurring basis. In April 2009, the FASB issued further clarification for determining fair

value when the volume and level of activity for an asset or liability had significantly decreased and for identifying

transactions that were not conducted in an orderly market. This clarification of the accounting standard is effective

for interim reporting periods after June 15, 2009, with early adoption permitted for periods ending after March 15,

2009. The Company adopted this clarification of the standard effective for the three months ended March 31, 2009.

The adoption of the provisions of this new standard did not materially impact the Company’s Consolidated Financial

Statements. In January 2010, the accounting requirements for fair value measurements were modified to provide

disclosures about transfers into and out of Levels 1 and 2, separate detail of activity relating to Level 3

measurements, and disclosure by class of asset and liability as opposed to disclosure by the major category of assets

and liabilities, which was often interpreted as a line item on the balance sheet. The accounting guidance also

clarifies for Level 2 and Level 3 measurements that a description of the valuation techniques and inputs used to

measure fair value and a discussion of changes in valuation techniques or inputs, if any, are required for both

recurring and nonrecurring fair value measurements. If the guidance issued in January 2010 is not adopted early, it

is effective for the first reporting period, including interim periods, beginning after December 15, 2009, except for

the requirement to provide detail activity of Level 3 measurements, which will be effective beginning after

December 15, 2010. The Company adopted this 2010 guidance effective with the three months ended March 31,

2010. See Note 5 for information on fair value measurements.

In April 2009, the FASB extended the fair value disclosures currently required on an annual basis for

financial instruments to interim reporting periods. This accounting guidance also requires entities to disclose the

methods and significant assumptions used to estimate the fair value of financial instruments on an interim and

annual basis and to highlight any changes from prior periods. These new disclosures are effective for interim

reporting periods ending after June 15, 2009, with early adoption permitted for periods ending after March 15, 2009.

The Company adopted the new disclosure requirements effective for the three months ended March 31, 2009. See

Notes 5 and 11 for information on the fair value of financial instruments.

In April 2009, the FASB issued new accounting guidance related to other-than-temporary impairments that

applies only to debt securities and shifts the focus from an entity’s intent and ability to hold until recovery to its